When you hear the word “budgeting,” do you cringe or feel a spark of excitement? If you hate hearing the "b" word, you're not alone. It’s not that you’re bad with money or doing something wrong. You probably just haven’t found a budgeting approach that works for your unique style.

The key to financial success is gaining clarity and understanding your money motivations. In fact, more than 86% of people say they budget regularly, and over 84% of them report that it’s helped them avoid debt or pay it off. The following 15 simple budgeting tips will help you move the needle in a positive direction so you can start living your best financial life.

1. Get a feel for how much you’ve spent in the past 3 months

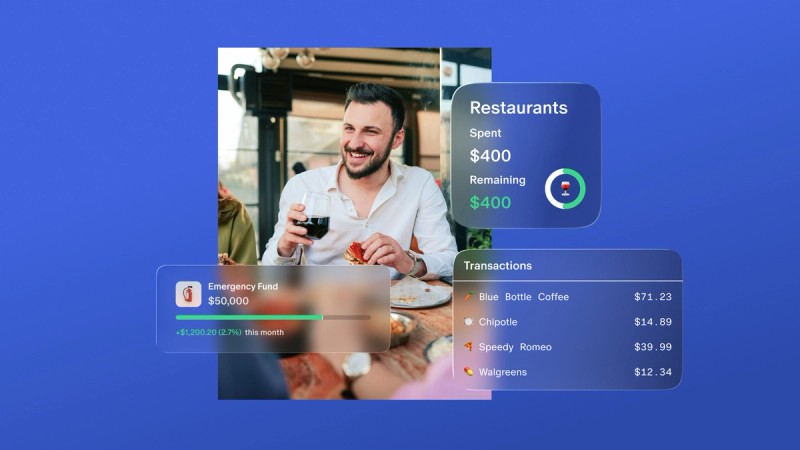

Don’t guesstimate where your money goes – use real data. Most of us think we know our monthly spending, but in reality we all have blind spots. Take a look at your actual spending over the past three months to see exactly how your money has been flowing in and out. A tool like Monarch makes this easy by aggregating your accounts and categorizing expenses, giving you a reality check on your spending habits. This retrospective will likely reveal trends (and surprises!) in your habits. Armed with that knowledge, you can pinpoint what needs tweaking and reallocate funds to the areas that matter most.

How to do it:

- Gather your statements: Pull bank or credit card statements for the last 90 days (or use a budgeting app to import transactions).

- Identify patterns: Notice how much you spend on essentials (like groceries, bills) versus non-essentials (dining out, entertainment). Are there any “leaks” (like frequent small purchases) adding up?

- Spot your blind spots: You might discover categories you underestimated – perhaps that “occasional” online shopping or those subscription services are costing more than you realized. Real numbers don’t lie, and they can help dispel any denial about where your money is going. Once you have this clarity, you can make informed adjustments to your budget.

2. Choose a budgeting method that fits your personality and money psychology

No single budgeting method works for everyone. Some people thrive with structure, others need more flexibility. The trick is to find a budgeting style that meshes with your personality and money psychology. Spend a little time reflecting on your habits and preferences before locking into a budget plan – it will pay off in the long run.

Popular budgeting methods:

- 50/30/20 rule: Allocate 50% of your take-home pay to needs, 30% to wants, and 20% to savings/debt. This is great if you want a simple framework without tracking dozens of categories.

- Zero-based budgeting: Assign every dollar a job each month (expenses, debt payoff, or savings) until you hit zero. This method offers maximum control and accountability, but requires a bit more effort and diligence.

- Envelope or cash stuffing system: If swiping a card makes spending too easy, try using cash (or digital envelopes) for different categories. When an envelope is empty, you’ve hit the limit for that category – a physical way to curb overspending.

- Pay Yourself First: Prioritize your savings and investments before anything else. Set aside a certain amount or percentage for your goals each month (automatically, if possible – see Tip #7) and use the remainder for expenses. This works well if you have trouble saving money when you pay bills then try to save what's left.

Monarch’s budgeting app is flexible enough to support whichever method resonates with you. The bottom line is: pick a strategy you can stick with. A budget that fits your life and psychology will be much easier to maintain than a one-size-fits-all plan that you dread.

3. Calculate your minimum monthly “survival” income

For anyone with irregular income or who just isn’t sure where all the money goes, it’s crucial to know your baseline needs. Add up all your mandatory monthly expenses – think housing, utilities, groceries, insurance, childcare, transportation, minimum debt payments, and other essentials you must pay to keep life running. This total is the minimum take-home income you need each month to cover the basics.

Knowing this survival number gives you a clear target. If your current income doesn’t cover it, you’ll need to adjust (by cutting costs or boosting income). If you earn more than this minimum, you then know how much is available for discretionary spending, savings, and extra debt payments beyond the essentials. This insight is empowering: it provides a foundation for your budget and ensures that at a minimum, you’re living within your means. Every dollar above this baseline can be allocated with intention (whether for fun or for accelerating your financial goals).

Tip: If your income changes each month, budget using your lowest typical income. In higher-earning months, save the extra to cover lean months so your essentials stay covered.

4. Set three key financial goals first

Without financial goals, budgeting can feel like a chore with no reward – money comes in, money goes out, and nothing really improves. Goals give your money purpose. Try setting three goals to start: one short-term, one intermediate, and one long-term. For example, a short-term goal might be to pay off a specific credit card in the next 6-12 months. An intermediate goal could be to build up your emergency fund to a comfortable level or save for a vacation or car over the next 1-3 years. A long-term goal might be to max out your retirement contributions each year or save enough to retire by age 60.

Make sure your goals are personal and meaningful to you. Maybe you want to be debt-free, buy a home, start a business, or simply feel less stressed about money. Write these goals down and assign target amounts and timelines to them. Clear goals will motivate you and guide your budget decisions – when you know what you’re working toward, it’s easier to direct extra dollars to those priorities. Let your budget reflect the life you’re building. Every time you allocate money, you’re effectively voting for the future you want, so set goals that get you excited about voting yes for your future self.

5. Start your emergency fund and slowly but surely build it

An emergency fund is your safety net for life’s unexpected surprises – the car breakdown, the sudden medical bill, the surprise job layoff. Building this fund is a journey that can take time, and that’s okay. Start with a modest milestone, like $1,000. Stash that away for true emergencies. Once you hit that, aim for one month of living expenses saved, then gradually work up to three months, six months, or even more if your situation calls for it. Financial experts typically recommend covering 3-6 months of expenses in an emergency fund as a rule of thumb.

Don’t be discouraged if you have to tap your emergency savings while you’re still building it – that’s what it’s there for. If you use some of it, just resume saving to replenish it as soon as you can. Over time, you’ll create a cushion that prevents a crisis from turning into debt. This is forward progress, not perfection, so celebrate each milestone you reach. Every dollar in your emergency fund is a dollar that can save you from financial ruin down the road.

6. Start with the 70/20/10 or 50/30/20 framework

If you’re not sure how to divvy up your income, try one of these classic budgeting frameworks as a starting point. They split your take-home pay into three broad buckets: Needs, Wants, and Savings/Debt.

- 70/20/10 rule: Allocate 70% of your income to needs (must-have expenses like rent, food, bills), 20% to wants (dining out, hobbies, entertainment), and 10% to savings and debt repayment. This ratio can work well if you live in a high cost-of-living area or currently have heavy expenses that make 50/30/20 tough to achieve. With 70% for the essentials, you ensure necessities are covered, while still carving out 10% to build wealth or pay down debt.

- 50/30/20 rule: Aim for 50% needs, 30% wants, and 20% savings/debt. This more balanced split gives a larger chunk (20%) to your future via savings and debt payoff. It’s a stretch target if your expenses are high, but moving toward this ratio will accelerate your financial progress. For example, trimming your needs from 70% of income down toward 50% (perhaps by downsizing expenses or increasing income) frees up more money to save and enjoy life.

These percentages aren’t set in stone – think of them as training wheels. If your current budget doesn’t fit neatly into one of these, don’t worry. Use them as a benchmark and adjust gradually. The value of this exercise is that it forces you to categorize your spending into needs vs. wants, and ensures you’re dedicating something to savings or debt payoff. Remember, budgeting isn’t about perfection; it’s about understanding how your money flows now, then making intentional adjustments from there.

7. Pay yourself first – automate Your savings

One of the golden rules of personal finance is to pay yourself first. This means treating your savings and investments like the first bills to pay whenever you get income. Why? Because if you wait until after you’ve paid all your bills and indulged throughout the month to see what’s left for savings, the answer often will be nothing. Instead, flip the script: decide on a portion of your income to put toward your future goals, and automate it before you have a chance to spend it.

Set up automatic transfers on payday to send money to a savings account, investment account, or to make an extra debt payment. Out of sight, out of mind – and working for your future. Automation removes temptation and saves us from ourselves by eliminating the need for willpower or remembering. You’ll learn to live on the remaining amount after paying yourself, effectively forcing you to budget what’s left. Many people find that after a month or two, they don’t even miss the money that’s being auto-saved or invested, yet their nest egg is growing steadily in the background.

Tip: Increase your automated savings whenever you get a raise or windfall.

8. Set spending alerts and bill reminders

Setting alerts, like the ones available in Monarch, will help you catch potential overspending and guide your decisions to keep you on track. You don’t have to obsessively check your bank accounts, instead alerts and reminders of when your recurring bills are due will help even out cash flow over the course of a month. Predictability makes your financial life easier to plan. There’s no need to be caught off guard in this day and age. Monarch can help you significantly with this.

9. Prioritize paying off high interest debt

High interest debt, usually any interest rate in the double-digits, isn’t doing you any favors. Focus on aggressively paying down high interest debt before any other goal. You’ll be shocked at how much money you’ll save on interest when you aren’t carrying a balance from month-to-month. Make it a priority to aggressively pay down these high-interest balances as one of your first major goals. Not only will you save a ton in interest charges over time, but you’ll also free up that monthly cash flow for more productive uses (like saving or investing) once the debt is gone.

A common strategy is the “debt avalanche” – list all your debts and focus extra payments on the one with the highest interest rate, while paying minimums on the rest. Once the highest is paid off, roll that payment into the next highest, and so on. You might be shocked how much money you save when you’re no longer carrying balances month-to-month. And seeing those balances shrink can be extremely motivating – each debt paid is a burden lifted off your shoulders.

Tip: Avoid taking on new debt. Budget a little “fun money” so you don’t feel deprived, but pause credit use if you can or follow this rule: if you can’t pay it off this month, don’t charge it.

10. Audit your subscriptions and auto payments

In the era of “subscribe and forget,” it’s easy to leak money on services and apps you barely use. Take time once or twice a year to audit all your subscriptions and recurring charges. Comb through your bank and credit card statements (or look at the “recurring payments” summary some banks provide) to spot any trials you never canceled, forgotten app subscriptions, or memberships that auto-renewed. Those $5, $10, $20 monthly charges can add up to hundreds over a year without you really noticing.

Cancel anything non-essential that you’re not actively using or that isn’t bringing you joy or value. You might be surprised at how many things you can live without when you scrutinize them. For the subscriptions you do keep, consider downgrading plans or sharing family accounts if possible to save a few bucks. Trimming this “subscription fat” can free up a decent chunk of money in your budget with very little sacrifice. And remember, you can always re-subscribe later if you truly miss something – but chances are you won’t miss half of those sneaky charges. This simple exercise could potentially save you big bucks annually just by cutting out the dead weight.

11. Negotiate your bills for better rates

Did you know many of your regular bills are negotiable? With a few polite phone calls, you might reduce the cost of your internet, cable, phone plan, insurance premiums, or even medical bills. Companies often have loyalty discounts, unadvertised promotions, or flexibility to lower your rate – but you have to ask.

Come prepared: mention competitor deals you’ve seen, or simply say you’re considering canceling or switching to a cheaper service. Many companies will offer a discount or promotional rate to keep you. Even things like medical bills can sometimes be negotiated by asking for financial aid programs or cash-pay discounts. The payoff can be significant: negotiating utility or service bills can potentially trim 5–20% off your monthly costs.

12. Negotiate your credit card interest rates

Just like your bills, you can sometimes negotiate your credit card interest rate. This is especially worth trying if you have a high-interest balance you’re working to pay off. Credit card issuers do have hardship programs or retention offers that they don’t advertise. Even a small reduction in your APR – say from 20% down to 15% – can save you a lot in interest and help you get debt-free faster.

13. Reward yourself for small wins

The road to financial freedom isn’t meant to be all sacrifice and no fun. In fact, celebrating your small wins is an important part of staying motivated for the long haul. Human psychology thrives on positive reinforcement – when you acknowledge progress, it actually boosts your motivation and confidence.

So, decide on some rewards for your milestones. Did you stick to your budget this week? Maybe treat yourself to a fancy latte or a movie night at home. The reward doesn’t have to be expensive – it just needs to be something you’ll enjoy. The key is that it marks the accomplishment and makes you feel good about your progress. This positive reinforcement creates a feedback loop that keeps you pushing toward the next goal.

14. Schedule times to review your spending on Monarch

A budget isn’t a “set and forget” document – it’s a living plan that will evolve with your life. Once you’ve built your budget in Monarch, make it a habit to review and adjust it regularly. This could be a quick bi-weekly check-in or a more thorough review each month. The idea is to compare your actual spending against your plan, track your goal progress, and make any necessary tweaks while things are fresh.

Treat this like a scheduled appointment with yourself. During these reviews, Monarch’s dashboards can help you see where you stood in each category, how close you are to your goals, and if any category consistently runs over or under budget.

Regular check-ins build strong financial habits and accountability. They prevent small issues from snowballing – you’ll catch that creeping subscription cost or the gradual increase in utility bills and can adjust proactively. Plus, you get to celebrate progress: seeing your net worth inch up or your debt balance go down over several months is hugely motivating. Consistency is key here. By staying engaged with your budget, you’ll feel more in control and less anxious about money, knowing there are no big surprises lurking. Monarch essentially becomes your financial co-pilot, but you still need to fly the plane at regular intervals!

15. Continue working on your money mindset

Here’s a little secret: financial success isn’t so much about numbers as it is understanding your personal relationship with money, your beliefs, habits, and emotions. When you make a purchase, notice how you feel (good, bad, or otherwise). All of us were taught lessons as children about money. Do the lessons you learned negatively or positively affect your monetary choices today? What stories are you telling yourself and how can we continually improve our relationship with money? This is a lifelong process, but we must be aware of our money mindset and rewrite any negative narratives.

Budgeting doesn’t have to be tedious and time consuming, nor is it about perfection. With the help of Monarch, you can easily get on a path toward financial independence and a less stressful life. You need to find a system that works for you and take small steps every day to move a little bit in the right direction. Great budgeting is about forward progress and setting ourselves up in a way that, when life gets tough, we won’t be derailed.