From gift exchanges, to parties, to traveling, the holiday season can be a wallop on your wallet. With rising prices for everything from plane tickets to eggnog, avoiding a holiday spending hangover in January seems impossible.

Don’t panic over your holiday expenses, or ask Santa for a short-term loan. Instead, plan your season spending the smart way with a holiday budget.

Like your month-to-month budget, a detailed, realistic holiday budget that tracks your spending in real time can go a long way to help you avoid debt and keep your savings intact for the New Year. This way, you can empower yourself to take control of your finances, worry less about how much you have left in the bank, and enjoy the holiday season.

Why a Holiday Budget Matters More Than Ever in 2025

This year’s holiday spending season is poised to be the biggest one yet, with Americans forecasted to spend over $1 trillion in 2025, according to the National Retail Foundation.

Despite this year’s big spending trends, economic uncertainty fueled by tariffs, layoffs, and a tough job market are leaving many Americans on uncertain terms with their holiday budgets. This might be one of the reasons that this 2025’s Cyber Monday drove over $1 billion in buy-now pay-later (BNPL) sales, according to spending data from Adobe.

Even with deferred payments, Americans are feeling the squeeze on holiday spending. According to a study by Bankrate, 78% of holiday staples such as candy, meats, sugar, and postage have increased in prices since September 2024.

Another Bankrate survey found 29% of shoppers are worried inflation is putting a strain on their budget. Over one in four (28%) holiday shoppers this season will take on debt to cover their holiday expenses, whether it’s by carrying a balance on their credit card or using BNPL services.

When holiday spending outruns your income, it can have long-term effects. Credit card and BNPL fees can rack up quickly, and dipping into your savings or investments to cover your holiday can lose you out on compounding interest. Going into debt to cover your holiday spending spree can quickly spiral out of control, which is why it’s crucial to keep your expenses in check with a holiday budget.

How to create a holiday budget in 6 steps

Planning out a holiday budget can help you keep your spending under control and make sure you have enough for all of your needs, wants, and plans. Here’s how to get started.

Figure out your income and fixed expenses

Like your monthly budget, your biggest factor in how much you can spend on your holiday budget will be how your income balances with your expenses. This way, you can be sure you’re still paying for housing, groceries, and electricity, and still keeping up with your goals.

A good rule of thumb is the 50-30-20 rule, where 50% of your income should go to needs, 30% to wants, and 20% to savings and investments. You’ll likely want to categorize your holiday spending under your “wants” category, on top of whatever your regular “want” spending.

Let’s say you have an income of $5,500 a month. Fifty percent of your income covers your rent, taxes, utilities, insurance, loan, and other essential payments, while you invest and save another 20%. You spend $100 per month on fixed “want” costs such as subscriptions. This leaves you with $1,550 for your holiday budget.

The next step is figuring out how you want to spend this $1,550 over the holiday season.

Create spending categories

When creating your budget, it’s a good idea to categorize your different expenses based on what you plan on spending in the season, such as for travel, gifts, and groceries.

Some of the categories you might want to include are:

- Gifts

- Travel expenses such as gas and flight tickets

- Accommodation costs for rentals and hotels

- Groceries for holiday meals and baking

- Activities and events

- Donations and charitable contributions

- Decorations

- Holiday cards and postage

- A mini “emergency fund” for unexpected expenses such as last-minute gifts, unexpected travel snarls, or other extra costs

By doing this, you can organize where your money goes and plan ahead, instead of burning through your allotted amount on one or two things.

Organize your priorities

Holiday spending doesn’t mean a break from practicing good financial hygiene. When you plan your budget, make sure to keep your overall money goals in mind.

If your top priority for the rest of the year is avoiding pricey credit card and BNPL debt, then you need to pay close attention to your spending throughout the month. Set a hard limit for yourself, and avoid going over it. Give yourself some buffer room with an “emergency fund” category for unexpected expenses during the holiday season, on top of your regular emergency fund.

Your categories will also help you figure out what to organize. Write them down in the order you want to prioritize them, with the first being the most important, and the last being least important.

If you want to go all-out on gifts without breaking the bank, you should look at where you can move your spending around to accommodate, such as holding back on eating out or cutting back on travel.

On the other hand, if you’re planning on flying out-of-state to see family, then plane tickets and other travel expenses will likely be higher on the list.

Figure out how much you want to spend

Once you have your categories created, allocate how much you plan on spending in each category with how much you have budgeted for the holiday season, based on what you’ll need to purchase. With our budget of $1,550, you might categorize your spending this way:

Category | Items needed | Amount |

Travel | Roundtrip tickets, checked luggage, pet sitter | $600 |

Gifts | Presents for mom, dad, sister, brother, niece, dog | $610 |

Food | Flour, eggs, ginger, sugar, icing, cookie cutters, turkey | $150 |

Family Cards | Cards, postage, envelopes | $90 |

Emergency | As needed | $100 |

Total | $1550 |

If you have a holiday budget from last year, use it as a guide to see what your typical expenses are.

While using a holiday budgeting calculator or planner can help you figure out some rough numbers, when it comes time to finalize your budget, you’ll want a way to track your expenses and transactions in real time so you can stay on top of your spending categories. More on this later.

See where you can cut costs

If your budget is looking too tight, you’re going to have to rearrange and cut back on some of your expenses. This is where your list of priorities comes in handy, since you can draw the line where you want to cut back, and where you want to keep your budgeted amount the same.

If you need to cut back, here are a few ideas for each category.

Gifts: DIYing presents, especially if you have a talent for sewing, baking or building, can go a long way. If you have a large family or friend group, consider setting up a Secret Santa gift exchange so each person only has to buy one gift.

Travel: Manage travel costs with friends and family by carpooling, agreeing to travel somewhere closer to you, or planning to travel on off-peak days for cheaper ticket and toll prices. Consider burning some travel points on your rewards credit card, if you have one.

Food: Plan meals ahead of time so you can grocery shop for efficiency. Instead of eating out or ordering catering, coordinate potlucks so that everyone brings their own dish. If you’re traveling, consider getting a rental with a kitchen.

Decorations: Re-use decorations from last year, or hit up the thrift store for some new holiday glitz. See if you can snag deals for lights, trees, and ornaments in the off-season to prepare for next year. DIYing decorations such as wreaths or garlands can be a fun family activity.

Activities: Look up free or low-cost holiday activities in your area such as public ice rinks, community caroling, and holiday markets. Movie and game nights can be great (and free) ways to connect with your family over hot cocoa.

If you’re really short on cash for the holiday season and need a way to fill the gaps in your budget you can also:

- Cut subscriptions for the month. If you’re not planning on going to the gym, or can mooch off of your cousin’s Netflix account for your family holiday movie marathon, skip your subscriptions for December and restart in January.

- Pick up on some side gigs. Gift wrapping services, pet sitting, and ride sharing are all in demand during the holiday season.

- Sell some DIY gifts. If you’re a whiz with a sewing machine, or make killer decorated cookies, see if you can hit up some local fairs and market your goods.

- Get rid of your extra stuff. If you have some extra decorations in your attic, or an ugly Christmas sweater you can’t bring yourself to wear, see if you can sell it online or at a consignment store. The closer it is to the holidays, the more in-demand it’ll be.

Keep track of your expenditures as you go

Core to staying on top of your budget is keeping an eye on your spending. It won’t do you any good if you check your Excel spreadsheet in January and see you’ve spent too much on ride shares. Instead, you need to track your expenses in real time so you can stay within the limits you’ve set for your budget.

Staying on top of your expenditures on the go can be complicated in the busy holiday season, especially if you have multiple accounts and cards to track. This is where money management platforms like Monarch can help you.

Set Up Your Holiday Budget in Monarch

When it comes to tracking cash flow and expenditures in real time, Excel can only get you so far.

Let’s say that you’ve got a busy holiday season ahead of you, with a big trip planned to visit your family out-of-state. You and your relatives are splitting an AirBnb for a week. Besides sharing costs, you need to keep track of how much you’re spending on flights, groceries, gifts, pet sitting, activities, and a last-minute present for your niece's new boyfriend who decided to tag along.

Here’s how you can create a budget in Monarch to keep track of your spending and stay organized during the holiday chaos.

Connect your accounts

If you’re new to Monarch, your first step is to link your financial accounts to Monarch so you can track your income, expenses, savings, and investments.

Even if you have an established Monarch account, be sure to update your accounts to accommodate for holiday spending if you’ve opened a new credit card, or are using BNPL for the holiday season.

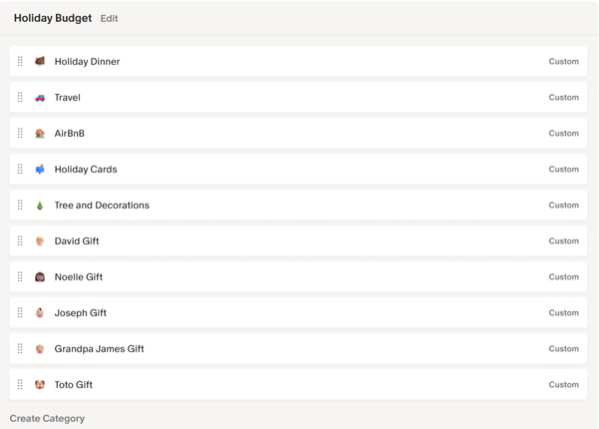

Create a holiday spending group and categories

Your first step is to create a new, non-monthly spending group for your holiday budget. This way, you won’t have your budget become a recurring expense from month to month.

After you’ve created your Holiday Budget group, you can then add new categories based on your typical holiday expenses, like travel, groceries, and gifts for individual people.

While you can lump all your holiday spending in one category, it can be helpful to split up your spending across different categories in a group. Categories help break your budget into more manageable pieces and give you the opportunity to adjust on the fly. For example, if you realize your gift fund is running a bit high, you can either dial back the spending or allocate some funds from the grocery budget.

Categories can also help track costs if you’re splitting bills with friends or family, or if you want to forecast your spending for next year.

If you find yourself needing a new category halfway through the month, you can always create a new one and adjust your spending and transactions accordingly.

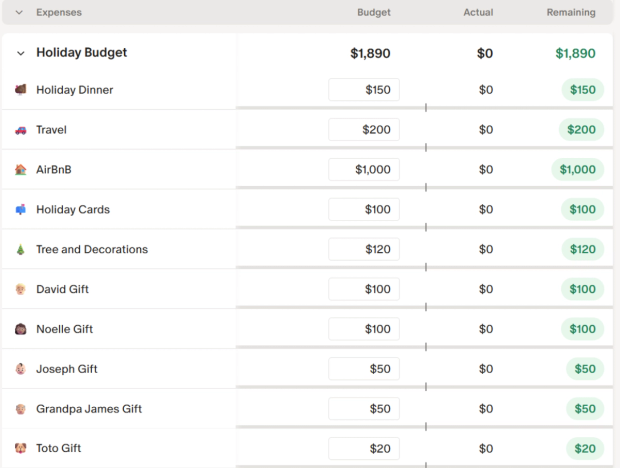

Set your spending limits

As you create your holiday budget group, you can set the amount you’re budgeting overall for the season, and then set individual limits for each category.

Monarch will show you how much money you have left over in your budget as you allot your spending.

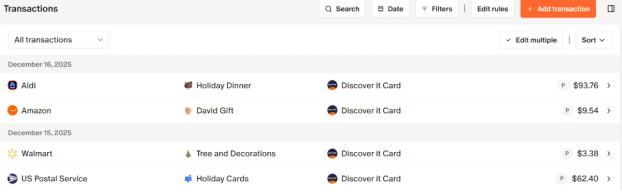

Keep track on the go

Now that you’ve set your holiday budget, you’re ready to go and take control of your seasonal spending. You can use the Monarch mobile app to categorize each transaction on your accounts with just a swipe, and add each transaction to the category you choose in your holiday budget group.

If you’re in a hurry, you can use Monarch’s AI tool to help you categorize your transactions as they come in. You can always reorganize them later if you want to categorize them in a different way.

Monarch helps you stay on top of your spending by tracking your allotments. If you go over the limit, you’ll receive a push notification and an email alert based on what you set in your preferences.

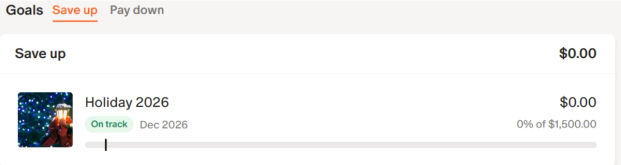

Set goals for next year

When January arrives, and you’ve (hopefully) avoided the holiday spending hangover, make it a New Year’s goal to set aside money for next December. You can add a goal in the Monarch platform, allot how much you want to save, and set a target amount to save each month in your budget.

Using your budget from the year before can give you a benchmark of how much you should save, with room to grow if you want to upgrade your gift-giving game. You can also use rollover categories, so if you end up spending less on one category than expected, you can have that amount rolled over into the next month.

Holiday spending doesn’t have to give you a holiday headache. With some planning, savvy saving and with the detailed budgeting features Monarch offers, you can take control of your holiday budget and make this holiday season a financial-stress-free one.

FAQs

How do I make a holiday budget?

Start by setting aside how much you’re willing and able to spend on the holiday season after you’ve paid for your monthly essential expenses, savings, and investments. Create categories within your budget and allocate how much you want to spend in each one, leaving some left over for unexpected expenses.

How much should I spend on holiday gifts?

How much you spend will depend on your income, your essential and fixed monthly expenses, and how much you’ve budgeted for your holiday expenses. Make a list of people you plan to give gifts to and to how much you’re willing to spend on each person, with the total being your holiday gift fund.

What categories go in a holiday budget?

While it depends on what you’re planning for the holiday season, categories can include travel, food, gifts, activities, charitable donations and decorations.

When should I start saving for the holidays?

As early as possible. Starting a savings category for holiday spending early in the year allows you to contribute a little bit each month until you reach your goal. Parking it in the high-yield savings account can also snag you some extra interest. You can set a goal in Monarch to track how much you save and see how far your contributions are going.

How can I avoid holiday debt?

Avoid debt by staying on top of your budget and making sure you don’t spend more than you can pay off at the end of the month. Monarch can track your spending in real time so you can keep an eye on your expenditures and dial back as needed. If you’re really worried, consider using cash or a debit instead of credit cards or BNPL, so you have a hard limit on how much you can spend.