Trying to manage your finances without a budget is like going roadtrip without a map or a GPS. You have an idea of your destination, but you don’t know which direction to go. If you make a wrong turn, you don’t know you’re off course for a hundred miles. In the end, you end up wasting time, gas, and money trying to figure out how to reach your endpoint.

A budget is essential for avoiding costly financial mistakes and achieving your financial goals, whether it’s paying down debt, saving for a house, maxing out your retirement accounts, or simply making sure you have enough to pay for your needs and wants.

Don’t use guesswork to manage your money. Here’s how you can create a budget that works for you with the power of Monarch.

What budgeting is and why it matters

Budgeting, in a nutshell, is the process of tracking your income and expenses and setting parameters around what you want to spend and save. In essence, it’s a plan for your money and where it’s going.

Think of budgeting as a trusty map that helps you stay on course as you work toward your financial goals. Whether you want to make sure you have enough for the essentials for the month, pay off debt, save enough for retirement, or aim to take a trip in a year, your budget will be your guiding star to manage your saving and spending habits. And, if you get blown off course, it will help you get back on track and focused on your mission.

Need more proof that a budget is essential? Here are some key stats to think about.

- Financial stress is common. According to a survey by Bankrate, 43% of Americans say that money negatively impacts their mental health. In that same survey, only 29% of respondents said they checked on their budget in the last month.

- Budgeting helps you manage your money. A survey conducted in Canada found that 99% of participants who used a budget reported it helped them stay on track with their finances, with 55% saying they used it to pay down debt, and 50% using it to save for the future.

- Budgeting helps you dodge impulse buys. That same study found that 56% of participants who used a budget reported resisting impulse purchases, compared to 46% of non-budgeters.

- Budgeting can boost your mental health. A study found that participants who regularly planned out their finances, paid off their credit card balance, and saved regularly had improved mental health over participants who did not.

- Budgeting remains a priority for many. One in ten (12%) of Americans report wanting to budget their spending better as a financial goal.

- Budgeting can make you more datable. Three in four (78%) of Gen Zers listed financial responsibility as an important trait when looking for a partner.

With a budget, you can achieve your financial goals, get your spending in check, and get insight on where your money is going for agency over your finances.

How to create a budget

Making a budget doesn’t have to be daunting. If you’re a beginner at budgeting, it really boils to nine basic steps:

- Calculate your income.

- List out your expenses.

- Categorize your expenses.

- Compare your expenses to your income.

- Establish your goals.

- Choose a budgeting method that works for you.

- Set your spending limits.

- Track your spending and make adjustments.

- Review regularly and keep an eye on your goals.

This structure assumes a monthly budget. While you can have a budget on a weekly, quarterly, or a yearly basis, budgeting on a weekly basis is a good way to stay on track with your overall budgeting trajectory. Most financial apps, like Monarch, offer budgeting on a monthly basis, so you can also adjust these steps for a longer or shorter-term budget if it suits your needs.

Here’s the step-by-step guide in more detail, and how you can use Monarch to your advantage every step of the way.

1. Calculate your monthly income

First off, you need to list your sources of post-tax income, which will tell you how much you make. When listing your income, you’ll likely want to categorize it into regular income and irregular income.

Regular income is income you bring in on a predictable basis and can be fairly assured will be the same number from month to month. Examples of regular income include:

- Paychecks from a full-time job

- Reliable business or freelance income

- Trust fund dispersals

- Social Security checks

- Full-time disability checks

- Retirement disbursements

Irregular income, on the other hand, is less predictable. You won’t know how much you’ll be bringing in, and it will vary greatly from month to month, or be a one-time windfall. Examples include:

- Side gig income

- Freelance income that is highly variable

- Stock dividends

- One-time bonuses

- Inheritances

- Prize winnings

If you have irregular income on top of your regular income, such as a side gig, you probably want to consider this “bonus” income to put toward savings or debt repayments instead of making it a major part of your budget. This way, if you don’t bring in your bonus income, it won’t squeeze your budget.

If your main income fluctuates, such as being on a commission basis, then you can either average out how much income you’re bringing in on a yearly basis, or set your income as the lowest amount you bring in each month.

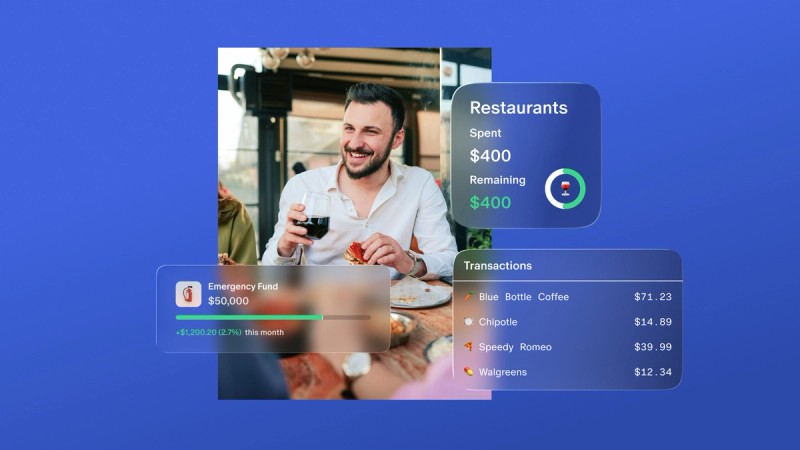

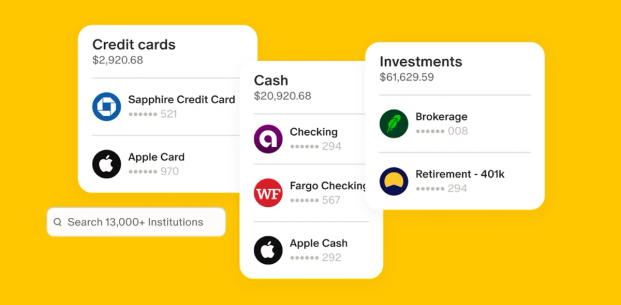

Monarch pro tip: Skip trying to hunt down all your pay stubs. Monarch can aggregate your income by linking your accounts, and updates your pay each month as the deposits come in. This way, you can know your cash at a glance in real time without having to manually log it.

2. List All Your Expenses

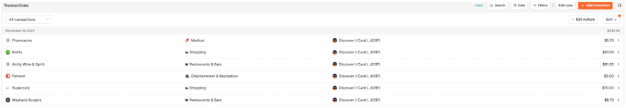

Next is tracking your spending. List all of your expenses for the past month, everything from housing costs to utilities, to your expenditures on groceries, clothing, eating out, subscriptions, and so on. If you mainly make purchases on a card or through a digital account, you can export your transactions and the merchants to an Excel sheet for easier tracking.

Otherwise, if you decide to go manual, or if you conduct a lot of cash transactions, you’ll want to keep track using receipts or a log. Be sure to list both the transaction amount and merchant if you do so. This will help you when you categorize your expenses later on.

Monarch pro tip: Using a budgeting app like Monarch can make this process much faster. You can automatically link bank and card accounts to help you quickly track your expenses, and add manual transactions on the go for cash payments.

3. Categorize your expenses

Once you have all your expenses recorded, it’s time to categorize them. Categories will help you determine where your money is going, and what you can cut down on.

Your categories will generally depend on what you spend the most money on and what you want to prioritize in your budget. It will also help you sort out how much you’re spending on essential and non-essential expenses.

Your categories, broadly, can include things like:

- Housing costs

- Utilities

- Subscriptions

- Groceries

- Eating out

- Clothing

- Tuition for school or daycare

- Debt repayments

- Insurance

- Gas and auto expenses

You can, of course, add additional categories if you need to, or be more detailed about your categories if you want a more granular idea of your spending. You can also keep your categories more flexible if you want to keep your options open (more on this later.)

Monarch pro tip: Using an app like Monarch can help you automatically categorize your expenses. It can set a category based on the merchant, and you can adjust or set new categories based on your preferences.

4. Subtract expenses from income

Once you have your categories set and your income and expenses totaled, subtract your income from your total expenses. This will give you the money left over after all your expenditures.

Categories will also be helpful when comparing your expenses to your income, since you can see how much you’re spending on each category as a percentage of your income, which you can calculate by dividing the category total by your income.

Here’s an example of how this might work out in table form.

Category | Amount | Percentage of income |

Income | 5500 | 100% |

Mortgage | -1750 | 32% |

Utilities | -250 | 4% |

Groceries | -700 | 13% |

Gas and auto | -500 | 9% |

Subscriptions | -150 | 3% |

Restaurants and takeout | -500 | 11% |

Debt repayment | -600 | 9% |

NET INCOME | 1050 | 19% |

Once you analyze your spending, you can get an idea of how much you have left over, and where you can adjust your spending. Your categories will inform you where you can adjust your spending if you want to allocate more to other categories.

For example, if you have a family, you may want to allocate more for groceries, childcare expenses, and insurance, and cut back on optional expenses such as eating out.

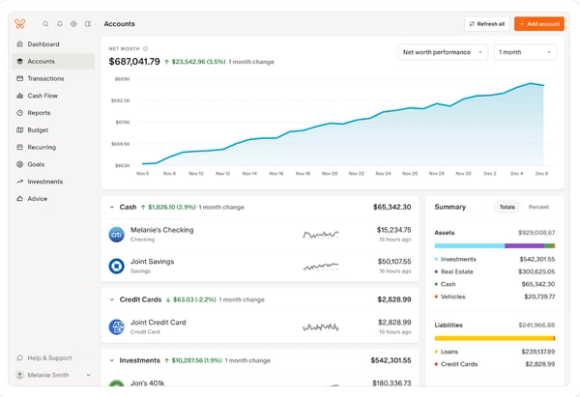

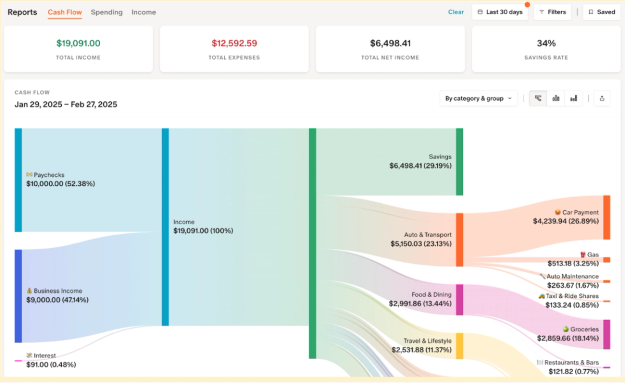

Monarch pro tip: Monarch automatically compares your income and expenses and helps you visualize what percentage of your monthly income is going to which categories under the Reports section.

5. Establish your goals

Your goals will inform how you want to work with your budget moving forward. Goals act as a guide for your spending and saving, and as a way to allocate funds you have either right off the top or from what you have left over every month.

Some financial goals can include:

- Reining in your spending so you don’t go into the negative each month

- Paying off debt

- Saving up for a vacation

- Getting on track with retirement

- Having more money for investments

As with all goals, it’s a good idea to set a benchmark and timeline for yourself based on how much you can save, or conversely, how much you need to set aside to reach your goal.

For example, when setting a goal, you might want to structure it as: “I want to save $600 to buy a new dishwasher in six months. I will do this by saving $100 each month by cutting back on takeout and taking on a side hustle for extra income.”

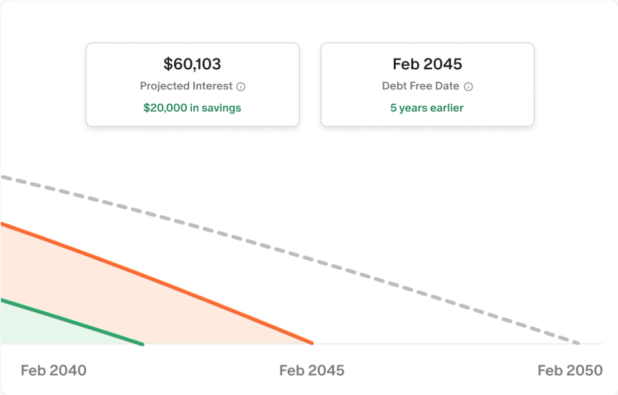

Monarch pro tip: With Monarch Goals, you can set goals for saving up or paying down debt, allowing you to track your progress in real time and tie your payments and deposits into your budget.

6. Choose a budgeting method that works for you

There are a variety of approaches to budgeting and figuring out how to set parameters around your spending. Which method works best for you will depend on your goals. Here are a few popular ones.

- Category budgeting is when you categorize your expenses by type (e.g. groceries, housing, automotive, retail shopping) and track your spending by how much you spend in each category. This can be helpful if you want specific insights into where exactly your money is going, and what you might want to adjust or cut down on based on your needs and wants.

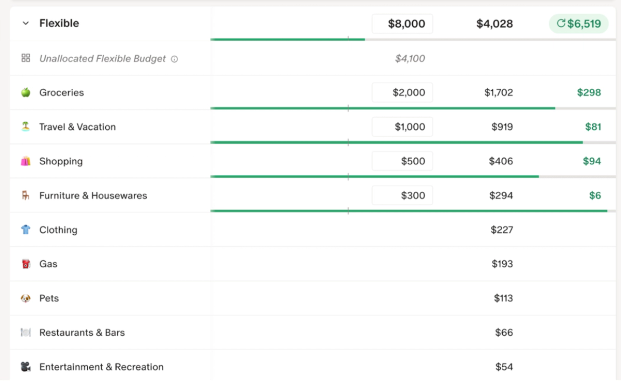

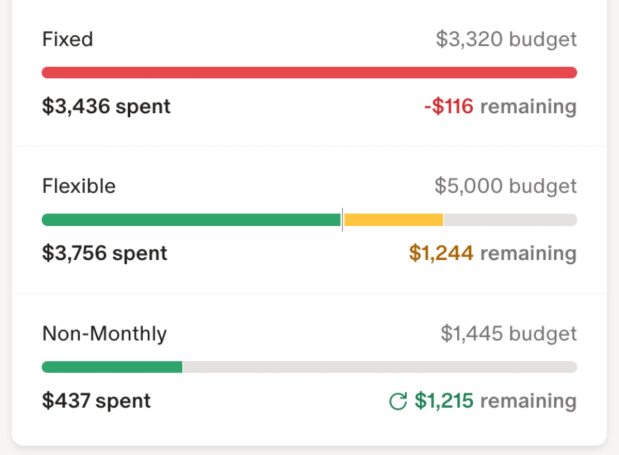

- Flex budgeting. Flex budgeting, also known as bucket or number one budgeting, is a unique method that categorizes expenditures into three buckets: Fixed, non-monthly, and flex. You use the Fixed bucket for set expenses such as your mortgage or subscriptions, and Flex for less predictable expenses, such as groceries or fuel for your vehicle, and set the total amount you’re willing to spend per week or per month. Non-monthly expenses include annual subscriptions and infrequent expenses like travel or gifts, which allow you to budget ahead of time for these expenditures and roll over any unused funds into the next month.

- 50/30/20. With this method, you allocate 50% of your budget to needs, 30% for wants, and 20% for savings and investments.

- Zero-based budgeting. This budget method has you allocate every single dollar you bring into an expense or savings category.

- Envelope budgeting. You allocate certain amounts of money to “envelopes”, or categories you select ahead of time. Once the money is spent, you can no longer pull from the envelope.

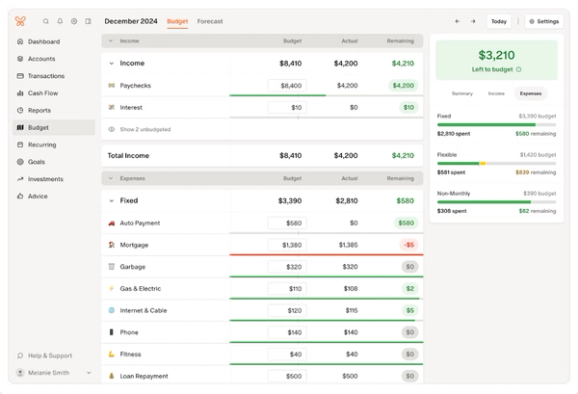

Monarch pro tip: Monarch works with your budgeting style and your preferences. You can choose between category budgeting or flex budgeting in the Budget tab under Settings.

7. Set spending limits

Now you can start allocating how much you want to spend on each category based on your goals and method.

Let’s say you decide, with a monthly income of $6,500, you want to use the flex budgeting method. Here’s how the spending limits might look for you. With the flex budget, you aim to keep your expenses below the thresholds you set, giving you some flexibility in how you spend while still keeping limits on your spending.

Category | Max Amount |

Fixed | $2.310 |

Flex | $3,190 |

Non-monthly | $1,000 |

To give a bit more detail, here’s how the breakdown might look by the types of expenses. While you don’t need to track by category with a flex budget, this can help illustrate what counts as a fixed or flex expense.

Category | Type | Max Amount |

Mortgage | Fixed | 1650 |

Utilities | Flex | 165 |

Groceries | Flex | 385 |

Gas and auto | Flex | 110 |

Debt repayment | Fixed | 275 |

Misc. needs | Flex | 165 |

Subscriptions | Fixed | 165 |

Restaurants and takeout | Flex | 990 |

Video game fund | Flex | 330 |

Misc wants | Flex | 165 |

Vacation fund | Fixed | 550 |

Emergency fund | Fixed | 550 |

Annual insurance payment | Non-monthly | 1000 |

Note how this budget includes a couple of “Misc. Needs/Wants” in each category. If your spending goes slightly over what you’ve planned out for each category, this will give you a bit of wiggle room to help you reconcile your budget.

Monarch pro tip: You can get alerted if you go over spending in any particular category in the Monarch app. Just go to Settings, then Notifications, and click on the “Budget Exceeded” notification toggle.

8. Track your spending and make adjustments

Now it’s time to track your spending. Like before, you can choose to track your spending manually by writing it down or using your bank and card statements to follow your transactions.

The key to tracking is staying on top of your spending in real time, since it won’t help you stick to your budget if you’re only realizing you overspent in the previous month. Instead, tracking in real time will help you pull back if you need to or reallocate funds from other categories.

Monarch pro tip: Monarch can track your transactions in real time with your linked accounts. If you want to stick to a Flex budget, set up a separate checking account with its own debit card and automatically transfer a set flex allowance once per week, keeping an eye on your balance whenever you’re about to spend on a flex category to make sure you have enough. This sets a physical limit on your spending.

9. Review regularly and keep an eye on your goals

Checking in on your budget regularly will help you stay on track, adjust your categories, and reconcile your transactions.

It’s a good idea to check in on your budget at least on a monthly basis, if not weekly or daily if you don’t have much wiggle room between income and expenses. When you do a budget check up, you should:

- Review your categories and make sure your spending is within the limits you set.

- Look at spending trends and see where you can cut back, if you need to.

- Make sure your income is consistent and hasn’t gone down.

- Check for any suspicious, unauthorized, or accidental payments.

- Review your subscriptions and cancel any you’re no longer using.

- Check your recurring expenses and make sure they haven’t increased.

- Make sure you’ve paid all your bills and debts, and that you haven’t incurred any late fees.

- Make sure your goal progress is on track.

You should also review your budget in-depth on a yearly basis to make sure you’re hitting your long-term goals and set up your categories and limits for the next year.

Monarch pro tip: Use data to drive your budget, not guesswork. Monarch generates live reports that instantly analyze and summarize your spending for the month, which categories have increased or decreased in spending, what your cash flow is looking like, and your progress toward your goals.

Budgeting for a Family vs. Individual

Depending on the size of your household, your budget, spending, and priorities will look a little different. Here’s the breakdown of budgeting for individuals and families.

Individual budgeting

Even if you have a family, budgeting for yourself can be a useful way to keep on top of individual expenses and see how they fit into the overall family budget, or your budget with a partner.

In general, your personal budget should include:

- Individual income

- Personal food expenses

- Personal housing expenses, split if you’re sharing in the rent/mortgage

- Personal clothing expenses

- Individual savings

- Personal transportation or vehicles

- Personal wants or gifts

- Personal hobbies

- Personal care such as hairdressing, nail care, or gym membership

- Individual subscriptions

- Medical costs

Family budgeting

Family budgeting covers expenses for the entire household, which includes all members of the household and expenditures for the entire family. You can use the personal budgets of each family member to factor into your total expenditures, giving you a way to track spending in a detailed way and giving you the bigger picture of your finances.

In general, a family budget should include:

- Combined income

- Housing

- Groceries

- Utilities

- Household costs such as cleaning supplies

- Home improvement or repairs

- Shared transportation/family vehicle costs

- Shared insurance premiums

- Shared trips or entertainment

- Shared subscriptions

- Shared savings

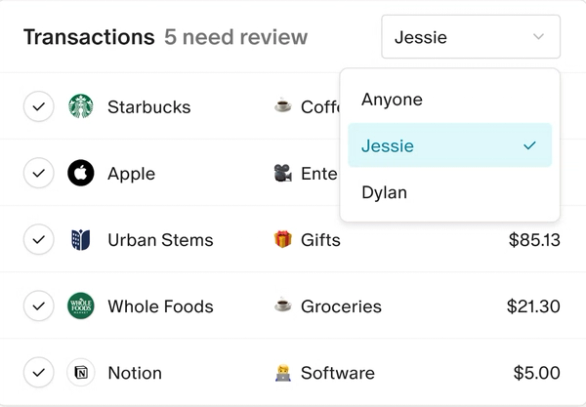

Monarch pro tip: You can use Monarch’s couples feature to combine finances with your partner for a shared look at your combined finances and your household budget.

Tips to Stick to Your Budget

Sticking to your budget takes discipline and focus. According to a survey by NerdWallet, 84% of Americans report overspending on their budget at some point in their lives.

Don’t let your spending outpace your goals. Here are some handy tips for staying on track.

- Automate your essential payments. Automating your bills and debt repayments will take the pain out of having to manually make the transaction yourself.

- Set alerts for spending. If you’re using a budgeting app like Monarch, set it so you’re notified if you spend over a certain amount in each category.

- Pay your bills early. If you have less money to spend later in the month, you’ll be less tempted to use it.

- Treat credit and Buy Now Pay Later as real-time funds. Instead of putting off recording your card transactions until the end of the month, treat your credit card like a debit card and only use funds you currently have. You can even pay off your card after each transaction or weekly if you are worried about racking up debt you can’t pay off.

- Freeze the credit card entirely. If you’re having trouble with overspending and are relying on credit, you might want to switch to a debit card or cash and freeze your credit cards literally - as in, put them in a container of water and throw it in the freezer!

- Give yourself a day before you impulse buy. Sleeping on purchases will tell you if you really want it, or if it’s just a passing feeling.

- Cut down on the ways you’re tempted to spend. Delete your food delivery apps, remove the cards you have auto-loaded onto your favorite shopping sites, and opt to go for a walk instead of window-shopping on your next vacation.

- Make yourself accountable to friends and family. Mentioning your goals and how you intend to achieve them, like not eating out for the month, can help you stay accountable, and have them be considerate of your spending habits.

Take Control with Your New Budget

Budgeting, while essential, doesn’t have to be a challenge. With Monarch, you can easily track your expenses and income, set up your categories, adjust your limits, stay motivated and disciplined, and help establish a financial plan that helps you achieve your goals, manage your spending, and make your finances work for you.

FAQs

How do I account for cash transactions?

You can manually enter any cash transactions you make. Alternatively, if you don’t use cash frequently, you can count a cash withdrawal as an expenditure and use the cash you withdrew as a “slush fund” that doesn’t need to be tracked, which can be useful if you want to give yourself a hard limit for a day trip or an event like a concert.

How much should I be saving each month?

That depends on your goals. Many experts recommend saving or investing about 10-20% of your income per month, including retirement or other investments, general savings goals, and debt paydown.

I’ve gone over my budget. What should I do?

If you’re part way through the month, see which categories you can cut back on to balance out the budget or if you can reallocate money from another category. If it’s the end of the month, cut back on planned expenses for the following month to patch the hole.

How do I budget for unexpected expenses?

Give yourself some wiggle room with "Miscellaneous" categories that can be used flexibly for anything unexpected. If you have a true emergency expense that goes beyond that, then you might want to draw on your emergency fund.