Student loans can be the key to unlocking your financial future. With college graduates making a median salary of over $80,000, or nearly twice as much as those with only a high school diploma, using student loans wisely can help you invest in yourself and your future for the long run.

Here’s everything you need to know about choosing, applying for, and managing your student loans.

What are Student Loans and Why Do They Matter?

Student loans are specialized loans that pay for educational expenses. You can get student loans from a variety of lenders, including federal loan servicers, banks, credit unions, and specialized lenders.

With in-state students paying $29,910 per year and out-of-state students paid $49,080 for the full cost of college per year at a public university, and private university students paying $62,990 per year in 2024, according to the College Board, student loans are becoming more of a need than ever to help cover the cost of education.

Like most types of loans, you’ll be expected to pay back your student loan with interest, though when and how much interest you’ll be charged will depend on the loan itself. In addition, student loans cannot be discharged as easily as other debt types in bankruptcy, meaning that you may face legal and financial consequences such as wage garnishment if you don’t pay.

What can Student Loans be Used for?

Student loans, depending on the type, can be used to cover costs for educational programs including undergraduate degree programs, graduate degree programs, trade and technical education programs, and professional graduate school programs such as medical school.

Student loans can be exclusively used for qualified educational expenses, including, such as tuition, books, and housing.

Keep in mind that using your student loans for unqualified expenses, such as starting a business, purchasing a house, buying non-educational items like concert tickets, can result in financial, tax and legal consequences from your lender.

Types of Student Loans

There are two key types of student loan available to borrowers: federal student loans and private student loans, which are offered by private lenders and available to borrowers based on income and creditworthiness.

Here are the loan types in more detail.

Federal Student Loans

Federal student loans are backed by the government and offered to US citizens and eligible non-citizens for costs at an accredited educational institution. They tend to be easier to qualify for, since most don’t require a credit check. They also can come with income-based repayment plans and possible deferral options based on hardship.

Keep in mind that federal loans don’t always cover the full cost of attending school, which means you may need to supplement them with private loans or a cash payment. You can apply for federal student loans through the Free Application for Federal Student Aid (FAFSA), which will offer you a certain loan package depending on financial need, your school’s tuition, and other aid packages you receive.

There are a few different types of federal loans currently offered.

Direct Subsidized Loans

Direct subsidized loans are loans that don’t accumulate interest while you’re in school, or for a six-month grace period after you graduate, drop out, or switch to part-time. This makes them the most affordable out of all the loan types. Subsidized loans tend to be limited based on income and tuition, and only a portion of your total federal loans can be subsidized.

These loans are only available to undergraduate students.

Direct Unsubsidized Loans

Direct unsubsidized loans will accumulate interest while you attend school, though payments are only due after the six-month grace period ends. You can borrow more with these types of loans, and they’re available for undergraduate, postgraduate and professional track students.

Direct PLUS

Direct PLUS loans are loans offered to parents and graduate students for expenses not otherwise covered by financial aid. These loans come with caps and may require a credit check to ensure the borrower does not have any adverse history. Interest accumulates from when the loan is dispersed, and taking out the loan comes with an origination fee. They also tend to have higher interest rates than Direct subsidized and unsubsidized loans.

There are two types available.

- Parent PLUS loans are available for parents who want to borrow on behalf of a dependent undergraduate. These loans are capped at $20,000 per undergraduate student per academic year, with a lifetime limit of $65,000 per student. These tend to have more limited repayment plans compared to Grad PLUS loans.

- Grad PLUS loans are available for students in postgraduate programs such as masters, doctoral and professional programs. They tend to have more repayment options and plans available than Parent PLUS loans. This loan type is being phased out on July 1, 2026.

Private Student Loans

Private student loans are any loan offered by a private lender, including banks, credit unions, online lenders, and even employers. Qualifying for these loans will require a good credit score and income, which means you may need to take on a co-signer in order to qualify.

Repayment plans tend to be stricter than federal student loans, since your lender will treat requests for deferral, forbearance, or changing your repayment plan on a case-by-case basis.

On the other hand, you have more options for refinancing your loans than with federal loans, and loan limits tend to be higher.

There are a few different options for private loans.

- Fixed interest rate loans have an interest rate that stays the same throughout the loan term. This means your payments stay consistent, and don’t adjust with the market rate.

- Flexible interest rate loans have an interest rate that adjusts to the market interest rate, which is set by the Federal Funds rate and other market forces. This means your monthly payment can fluctuate during the repayment period.

- Income share agreements are a form of loan where students' educational costs are paid for in exchange for paying a percentage of their future income over an extended period. These are offered by some colleges for certain degree programs, employers, and private providers.

How to Choose the Right Loan for You

Picking out the right loan is just as important as picking the right school for you, which is why it’s important to weigh the pros and cons of each student loan type.

Of course, you can always take out a combination of federal student loans and private loans. One option is to maximize how much you borrow in subsidized and unsubsidized loans, and then cover the rest of your college costs with private loans if you can get a good interest rate.

When evaluating what kind of loan to take out, here are some criteria to consider.

You Might Want to Consider Federal Student Loans if:

- You qualify for subsidized loans. Being able to defer interest accrual during school will help you save on future repayments.

- You want more flexible repayment options. Federal loans come with more paths to repayment, including income-based repayment plans, deferment and forgiveness.

- You don’t have a credit score or cosigner to qualify you for a private loan. Federal loans generally don’t have credit requirements like private loans, or have lower thresholds.

- You plan on using a government forgiveness program. If you plan on using a forgiveness program such as Teacher Loan Forgiveness, know that only certain types of federal loans are eligible for forgiveness.

You Might Want to Consider Private Loans if:

- You’ve exhausted your federal student loan options. Private loans can be a good way to fill the gap if you don’t qualify for federal loans, or if they aren’t enough.

- You can get a better interest rate. If you or your cosigner have a good credit score, you may be able to get a lower interest rate than a federal loan.

- You want more options for refinancing. Private loans can be refinanced for a better rate, unlike federal student loans.

- You have a cosigner or a credit score that qualifies you. While there are some bad credit loans available, you’ll get a much better interest rate and loan terms if you or your cosigner have a clean credit history and high credit score.

How to Apply for Student Loans

The student loan application process will vary depending on whether you decide to take out federal loans, private loans, or a combination of both. It’s a good idea to have an idea of what options you have available to you, which is why your first step, regardless of your loan type, is to fill out your FAFSA.

Completing your FAFSA application will not only qualify you for federal student loans, but other forms of financial aid such as tuition assistance, scholarships, work studies, and other ways to help you pay for college. The FAFSA generally opens applications for the following academic year on October 1. Deadlines vary by state and college, though it’s a good idea to apply as early as possible, as aid is offered on a first-come, first-serve basis.

That said, here’s the process you should follow when preparing to apply.

- Gather your documents. Both the FAFSA and your loan applications will require you and your parent/guardian’s incomes, assets, Social Security numbers, and other pieces of personal and financial information.

- Fill out your FAFSA. You can do this at www.studentaid.gov/h/apply-for-aid/fafsa

- Review your Student Aid Report. After you’ve filled out your FAFSA, you should receive a form detailing how much financial aid you qualify for, including FAFSA-based scholarships, tuition assistance, work-study programs and federal student loans.

- Compare schools, tuition, and financial aid offers. Look at how much each school will cost, how much they’re offering you in financial aid, and how much you’ll need to borrow.

- Compare loans. Once you have an idea of how much school will cost, look at your loan options. See if federal loans will cover the cost, what interest rates you’re being offered, and what combination of loans will work best for you.

After this, you can move forward with your federal and private loan applications, depending on your needs.

For Federal Loans:

Once you’ve decided on which school you’ll attend and have received a financial aid offer, you’ll want to reach out to the financial aid office, which will confirm your aid and eligibility and send you a master promissory note (MPN) to sign. You’ll also have to complete a counseling course that will run you through the loan dispersal and repayment process.

For Private Loans:

If you decide to go with a private loan, you’ll have to go through the lender’s individual loan process. In general, you’ll:

- See which loans you qualify for. Check your credit score and history at freecreditreport.com and compare lenders based on their credit requirements and fees.

- Find a co-signer, if needed. If you don’t have any credit history, you’ll want to have a co-signer with a good credit score, who will promise to pay back the loan for you if you are unable to pay.

- Fill out a loan application. You can usually do this online, depending on the lender. Some lenders may give you a pre-qualification offer based on your application as soon as you submit it.

- Undergo a credit check and underwriting process. The lender will see how much of a credit risk you are, and confirm your income and other details.

- Wait for approval. Approval will usually take one to two weeks, depending on the lender. If approved, you’ll receive an approval letter with a loan amount and an interest rate.

Understanding Interest Rates and Loan Costs

Borrowing isn’t just a matter of paying back your initial balance. Your loans will typically have other costs associated with it, which will depend on the loan type and your servicer.

When shopping for loans, you’ll often see a number known as the annual percentage rate (APR). This number presents the cost of borrowing, which includes the interest rate, lender fees, and other costs from the lender. Comparing the APR will give you a good idea of how much your loan will roughly cost and allow you to compare lenders.

Here are some of the costs broken down.

Interest

Interest will be one of the biggest costs you’ll expect to pay. Most student loans will have compound interest, which means that interest will be calculated on the current loan balance and whatever interest has been added to it.

Your repayment plan will account for this accumulated balance and divide out your payments so you pay off both your initial balance (also known as the principal) and the interest. You can use a calculator to see how much interest you’ll end up paying overall, as well as how long it will take for you to pay off your loan.

Interest rates for both federal and private loans are based on rates set by the Federal Reserve, which the Fed adjusts based on the economy. For private loans, your interest rate will also be based on the credit score of you and your cosigner.

Origination Fee

The origination fee is what a lender charges you for processing the loan. This can range from 1% to 5% of the loan, depending on the lender. Both private and federal loans come with an origination fee. With federal loans, the origination fee is usually subtracted from the loan dispersal, while with some types of private loans, you may need to pay it outright.

Underwriting Fee

Private lenders may charge you an underwriting fee on top of your origination fee. This fee covers the cost of checking your credit history.

How Much Should You Borrow?

How much you’re able to borrow in student loans is dependent on a few factors. The less you borrow, the less you’ll owe and have to pay back over time, so be sure to only borrow as much as you feel you’ll be able to comfortably pay back with your future salary.

In general, you should consider:

- How much your tuition is. Federal loans are generally based on tuition costs, which will also determine if you need to take out private or PLUS loans to cover the remainder.

- How much financial aid you receive. The more aid you receive in the form of scholarships and grants, the less you’ll have to borrow. Federal loans are also adjusted based on financial aid.

- Your loan type. Federal loans generally have lower limits than private loans.

- How much you have saved for college. If you have a 529 or other college savings plan, you should use those funds to pay for school before you borrow.

- Your family’s income. Financial aid and certain types of federal loans will be offered based on how much your household makes. Conversely, you’ll qualify for more in private loans the more your co-signer makes.

- Interest rates. The higher your interest rate, the higher your monthly payment will be. As such, try to minimize how much high-interest debt you take on.

- What you expect your other costs to be. Housing, books, fees, and other costs will contribute to your final bill. Many colleges offer a general estimate of these costs online.

- Your future salary. You can look up wage and employment data through the Bureau of Labor Statistics, which should give you a good idea of how much you’ll be making and how comfortably you can pay back your loan.

- Other debt you have. If you already have student or other types of debt, you may be limited in how much you can borrow.

How to Borrow Less for College

In 2024, the average student loan debt balance was $38,883, according to Experian. Keeping the cost of college low can help you graduate with less debt, which means less paid in interest, more flexibility with how much income you need in a job, and fewer financial worries.

While borrowing for school isn’t necessarily a bad thing, here are a few ways to reduce costs so you don’t have to borrow as much.

- Consider community college. Earning an associate’s degree from a community college can open up job opportunities, or allow you to earn credits toward your bachelor’s more cheaply.

- Attend your in-state school. In-state tuition and financial aid can go a long way.

- Apply for scholarships. Many schools offer in-house scholarships to students who apply. Private companies and nonprofit organizations can also offer grants to qualifying students.

- Take summer courses for core requirements. Summer courses are sometimes cheaper than fall and spring semester courses.

- Live off-campus. Living in a shared house or apartment and cooking your own meals is often cheaper than living in the dorms with a meal plan.

- Do a work-study program. Working through college will help you gain experience and cover costs you would otherwise

- Cut down on book and supply expenses. See if you can share a textbook with classmates, buy one secondhand, or ask your professor for a borrowed copy.

- Plan your time in college. While college is a time of discovery, planning out your degree and courses so you graduate on time or early can save you on loans.

How Student Loan Repayment Works

Most student loans are installment loans, which means you’ll pay a set amount each month for a given period until the loan is paid off. Rules vary as to when you’ll be required to start making payments.

- Subsidized and unsubsidized federal student loans will start requiring payments six months after you graduate, drop out, or switch to being a part-time student. Payments can be deferred by military service or re-enrolling in school.

- PLUS loans require payment after the loan is disbursed.

- Private student loans will vary in their rules, but will usually have a grace period of a few months after your graduation date.

When it’s time to repay, your loan servicers will send you a repayment schedule based on the sum of your loans they hold and the interest rates you’re being charged. Repayment terms can range from 5 to 25 years, depending on the size of the loan. If you have multiple loans and multiple servicers, you may have to make multiple payments unless you consolidate or refinance.

Something to keep in mind is that private and federal student loans come with different repayment plans.

Federal Student Loan Repayment Plans

With federal student loans, you can choose how to repay from four different plans, depending on your eligibility.

- Standard repayment is when you make regular fixed payments for the loan term, usually within 10 years.

- Graduated repayment plans start off with smaller payments that increase at regular intervals, with the goal being to pay off the loan balance within 10 years.

- Extended repayment plans, which are only available to borrowers with more than $30,000 in Direct loans, offer fixed or graduated payments over a 25 year repayment period, lowering your payments.

- Income Driven Repayment Plans (IDR) allow you to make payments as a percentage of how much you earn. These plans are only available to borrowers who make below a certain amount, and have limitations based on the plan and loan type. There are four main IDR plans available, with their own conditions and repayment periods.

When choosing a repayment plan, it’s a good idea to sit down with each payment schedule and see how much you’ll pay each month compared to your income and emergency fund, how much interest you’ll pay overall, and how long it will take to pay off the loan.

Private Student Loan Repayment Plans

Private student loan repayment plans will vary by lender, but generally include:

- In-school interest-only payments. With this plan, you pay only the interest on the loan while you’re in school, preventing the balance from growing, and only start paying the principal and interest after you graduate.

- Immediate repayment. With this, you immediately make full payments while in school. While this can be a balancing act when you’re a student, you’ll pay off the loan sooner and pay less overall interest.

- Full deferral. You only start making full payments after you graduate, drop out or drop to part time, and after the grace period has ended.

Paying Off Student Loans While You’re in School

While it’s not always required that you pay off your student loans while you’re in school, making even small monthly payments can have benefits, including:

- Paying off your loan sooner. If you pay $25 a month for four years, you’ll have knocked $1,200 off your balance, which can translate to a few months’ worth of payments.

- Establishing a good credit history. If you have no credit score, making early payments will establish positive entries and give you a head start, which can be useful for opening a credit card, taking out other loans or renting an apartment later down the line.

- Saving on interest. Knocking off some of your loan principal early on can save you hundreds of dollars in compound interest.

Refinancing and Consolidation

Both refinancing and consolidation are rearrangements of your student loans. While the balance stays the same, your interest rates, monthly payment, and repayment terms will change.

When refinancing or consolidating, you’ll likely be charged an origination fee by your new lender, as well any other processing or underwriting fees. Depending on the loan type, you may undergo a credit check as well, which will determine the new interest rate you’ll be charged.

Refinancing

Refinancing a loan is when you take out a new loan for the balance of the old, and use the dispersal to pay off the old loan, giving you new terms and a new interest rate.

Refinancing can be helpful if you want to take advantage of lowest interest rates, change your interest rate from flexible to fixed (or vice versa), lower your monthly payment with a longer repayment period, or switch loan providers.

Consolidation

Consolidation combines multiple loans into a single loan for a single interest rate and monthly repayment. This can make managing your loans more simple and even lower your monthly payment by extending the loan terms. Your overall interest paid, however, may increase, as your interest rate will be averaged out between the loans.

Consolidation is available for both private and federal Direct loans.

Keep in mind that if you consolidate any federal loans during the grace period, you forfeit the remainder of the grace period and must begin making payments immediately.

Loan Forgiveness and Cancellation Options

In certain circumstances, you can have your federal student loans forgiven, cancelled, or discharged, which means you no longer have to make payments on them.

While this can represent a financial burden taken off your shoulders, keep in mind that you’ll have to meet specific criteria and a possibly long waiting period before your loan is considered for discharge. This is also generally only an option for federal loans, as private lenders tend to require you to pay back your balance no matter what.

Student loan discharge options include:

- Public Service Loan Forgiveness. This option is available to qualifying public servants, including teachers, government employees, or nonprofit workers, and are for Direct loans only. This program forgives your loan balance after you’ve made at least 120 qualifying monthly payments and are working for a qualifying employer.

- Disability Discharge. If you have a permanent and qualifying disability, you may qualify for having your Direct loans forgiven.

- IBR forgiveness. Those on an income-based repayment plan may qualify for forgiveness of Direct loans if they have made payments for at least 20 or 25 years, depending on the date of initial dispersal.

- School closure. If your school closes while you’re enrolled or soon after you graduate, you can have your Direct loans discharged.

- School misconduct. If your school is found to have engaged in misconduct such as misleading advertising about degree quality, job placement, or tuition costs, you can have your Direct loans discharged.

- Forgery. If your loan was made in your name but not with your approval due to forged documents or signatures, you may qualify for cancellation.

- Bankruptcy. It is possible for federal and private loans to be discharged in bankruptcy, though you will have to file evidence of hardship and undergo a separate lawsuit.

- Death. All student loans are discharged if the borrower dies.

Strategies to Pay Off Student Loans Faster

Paying off your loans quickly can save you on interest, improve your debt-to-income ratio and free up your income for other uses. Here’s how to supercharge your loan payoff process.

- Make extra payments. Putting an extra cash you have toward your balance will help you pay it down more quickly.

- Use a loan repayment strategy. Using the debt snowball or debt avalanche method can help you focus on high-interest debt and pay it off for maximum effectiveness.

- Find a job with an employee repayment program. Some employers will offer student loan payments as part of their compensation package if you stay with the company for a certain period of time.

- Use autopay. Keeping your payments automatic will keep you from forgetting and keep them consistent.

- Balance your budget for extra cash. Combing through your monthly spending and seeing where you can cut down can help you dedicate more funds to your payoff process.

Balancing Student Loans and Your Financial Life with Monarch

Monarch can help you track your student loans and tackle your debt head-on, whether you’re still in school or paying off your balance.

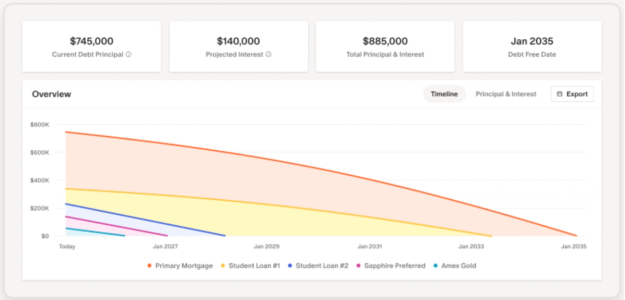

Since keeping track of multiple accounts can get complicated quickly, Monarch offers a quick and easy way to see your debt balances all in one place with the Debt Dashboard. By plugging in your account info, you can get a quick and live look at your entire loan balance, as well as individual balances, payments, and interest.

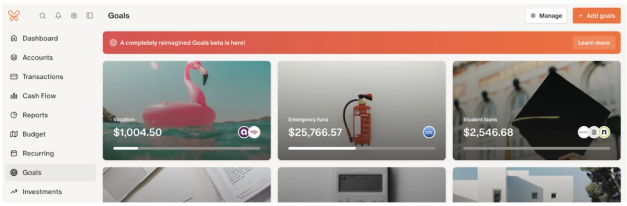

As you pay off your balance, you can use Monarch’s Pay Down Goals features to not only see your payoff date, but to run simulations based on payment amounts, repayment strategies and one-time payments, which can inform you when your final payoff date is and how much interest you’ll have to pay.

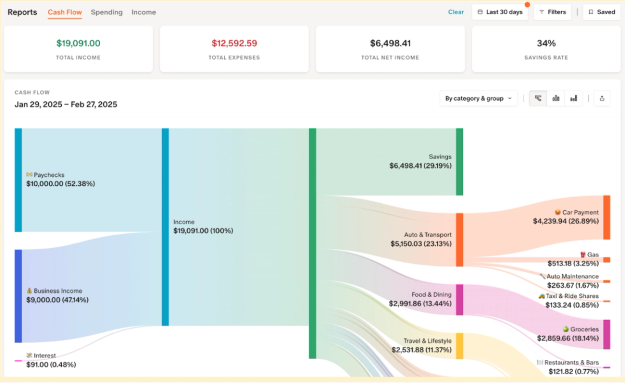

Monarch can also help you fit your loan payments into your every day budget. With cashflow and payment projections made easy from your linked accounts, you can easily see where your money is going, how much income is going toward your debt repayments, and where you shift your spending to pay down your balance faster.

If you’re ready to tackle your student debt repayment journey head on, give Monarch a try.

Conclusion

Student loans can offer a way to invest in your future and pay for college, graduate school, and professional training. Both federal and private student loans can give you a way to pay, though both have different requirements. Federal student loans come with a variety of repayment options and subsidized interest, while private loans offer higher limits and more refinancing options.

Paying off your student loans takes dedication and a tight pulse on your income and your budget, which is why a financial app like Monarch can empower you to build the student loan repayment plan that can get you debt-free and ready to enjoy your postgraduate life.

FAQs

What are some alternatives to student loans?

If you don’t want to borrow money, you can pay for college with your savings through a 529 account, rely on scholarships and financial aid, or join a program that offers tuition compensation, such as the United States military.

Can I take out both federal and private student loans?

You can. Many students use a combination of public and private loans in order to cover their tuition. You will have to keep track of separate balances, however, and be aware that different repayment options exist for both loan types.

Do I need to apply for student loans every year?

Yes. Generally lenders will have you apply for new loans each year or semester as your tuition and fees are charged. You’ll also have to fill out the FAFSA each year.

What happens if I don’t pay off my student loans?

Failure to pay either federal or private student loans can result in garnished wages, seized assets, seized tax refunds, and lawsuits, as well as negative reports on your credit history and a lowered credit score.

Can I get a student loan with bad credit?

There are student loan options for those with bad credit, including bad credit private student loans, which may require a deposit or down payment and come with higher interest rates. Direct federal student loans also don’t require a credit check.

Are student loans a good idea?

Like any investment, it’s about the returns you receive. Student loans are a good idea if you believe your education will help you get a higher-paying job than without. There are many ways to help cut down on the cost of your education so you don’t have to take out loans, including going to community college or your state school, or getting scholarships.