HELOCS. Auto loans. Mortgages. Student loans. Revolving credit. Just hearing these terms might make your head spin, especially if you’re trying to decide on a loan for your borrowing needs. The lending market has a huge variety of products to offer, and picking one out can be daunting.

Don’t get lost in the details of choosing a loan. If you’re looking to borrow, whether it’s for your education, your vacation, or your first home, here is what you need to know about different loan types, and what to expect.

Loan basics: secured vs. unsecured, installment vs. revolving

Loans can be structured in a few different ways, which will determine how much you can expect to pay each month, how much interest you’ll be charged, and the requirements for each loan.

Secured vs unsecured loans

The key difference between a secure and an unsecured loan is collateral.

Secured loans: These requires collateral, such as a house, a vehicle, or an object of value, that the lender can legally seize and sell if you do not pay back the loan on time. Typically when you use a loan to buy an asset such as property, the asset is used as collateral. Mortgages, auto loans, and business equipment loans are examples of secured loans.

Because the loan is secured, it can be easier to be approved for, and often comes with lower interest rates.

Unsecured loans: These don’t require collateral. While this means your property isn’t at risk, and that you don’t need to come up with collateral for the loan, it’s often harder to get approved for unsecured loans.

Installment vs revolving loans

Besides secured and unsecured loans, your loan can also differ in how the payments are structured. The key difference is whether your loan is an installment loan or a revolving loan.

Installment loans: These also known as term loans, have you borrow a lump sum and pay back the balance each month, with the payment being generally the same over the payment period. For example, if you borrow $500, you’ll be expected to pay back $50 in monthly installments over the course of 10 months, plus interest.

Mortgages, business loans, auto loans, student loans, and personal loans are all generally installment loans.

Revolving loans: These also known as credit, are more open ended. Instead of a lump sum, borrowers can borrow against a line of credit and pay back the balance repeatedly. For example, with a line of credit, you can borrow $500, pay back $200, and then borrow another $100 for a balance of $400. Generally, lines of credit will have an upper limit to how much you borrow based on your credit history and salary. You’ll also generally have a minimum monthly payment you’re expected to make if you have a balance.

Interest on revolving loans depends on the balance you have at the time interest is charged. Some revolving loan types will have a “grace period” where you aren’t charged interest on the balance if you pay it off in that time.

Credit cards and lines of credit are examples of revolving loans.

Major loan types

Now that we’ve covered the basics of loan structures, let’s look at the major types of loans the market has to offer.

Mortgage and home loans

When you’re buying a house or condo for the first time, chances are you’ll have to take out a loan to cover the full cost of the home. Mortgages are a secured loan, with the house being used as collateral in the loan agreement.

Mortgages tend to offer low interest rates compared to personal, auto, and credit card loans. However, they generally require a credit score of around 620, enough income to cover the monthly payment, and a down payment in order to qualify.

There are a few different types of home loans to consider.

Conventional loans

Conventional loans are loans backed by private lenders, and are one of the most common mortgage types in the United States. They come with 15 and 30-year terms and generally require Very Good to Excellent credit and a down payment of 3%.

Government-backed loans

Government-backed loans are loans guaranteed by the United States government. This allows borrowers who would not be able to afford a conventional loan, or who have lower credit scores, to access the housing market.

Examples of government-backed loans include Federal Housing Administration (FHA) loans, USDA loans, and Veterans Association (VA) loans. Requirements vary among loans, and they may require additional inspections and paperwork.

Home equity loan

A home equity loan, sometimes referred to as a second mortgage, is a loan against your home equity, or how much of your home’s value you own. A home equity loan can be taken out on a house you already own outright, or on a home that has a mortgage on it.

For example, if your house is worth $400,000, and you have a $100,000 mortgage balance on it, then you have $300,000 of equity you can borrow against.

HELOC

A home equity line of credit, or a HELOC, is a revolving line of credit you can take out against the equity of your home.

A HELOC operates a bit like a credit card. During the draw period, you can withdraw as much or as little as you need. Once the draw period ends, you only have to pay back and are only charged interest on the balance.

HELOCs can be a useful way to get flexible cash for things like home renovation projects if you don’t know how much you need to borrow, and often come with lower interest rates than credit cards or unsecured lines of credit.

Auto loans

Auto loans, or car loans, are loans used to finance a car or vehicle. They’re a type of secured loan, with the car used as collateral to secure the loan.

When applying for a car loan, it’s a good idea to have a Good (670+) or better credit score, as well as a down payment of 10% or more.

One thing to remember about auto loans is that, unlike real estate, cars are a depreciating asset, which means that their value decreases over time. If you sell your car before the loan term is up, you run the risk of owing more than the car is worth.

Student Loans

Student loans are used to pay for education at an accredited college, university or training school. They can be used to cover tuition, books, housing, and other costs of education.

Student loans typically don’t need to be repaid until your date of graduation, with some not even charging interest until that point.

There are a couple of different types of student loans to choose from.

Government-backed student loans: Student loans such as federal loans and Parent PLUS loans are backed by the federal government, and often come with fixed interest rates, more flexible payment plans, and lower credit requirements than private loans. They’re offered based on your family’s household income.

Private student loans: These are offered through private lenders, and can come with variable or fixed interest rates. They have higher credit requirements than government loans, and thus require a co-signer on the loan.

If you want to avoid student loans, you may want to consider applying for scholarships or financial aid through the Free Application for Federal Student Aid (FAFSA)

Business loans

Business loans are used to finance the costs of starting, running or expanding a business, such as buying equipment, funding inventory, or paying rent for a business location.

When taking out a business loan, the lender will consider your business’s profit and loss statements, your personal and business credit history, as well as the business pitch you make to the lender.

If you own or are starting a small business, you may qualify for a Small Business Administration (SBA) loan, which is a government-backed loan offered to small businesses owners who don’t qualify for a conventional business loan.

Personal loans

Personal loans can be used for any purpose, from vacations to home renovations. They’re often offered by banks, credit unions, and online lenders.

Personal loans are typically unsecured, depending on your creditworthiness, and can offer lower interest rates than credit cards. You can choose to secure a personal loan with collateral, which can offer you a lower interest rate at the risk of losing your collateral if you default.

Credit cards

While credit cards themselves aren’t a type of loan, they offer a revolving loan in the form of a line of credit. When you pay using a credit card, you add to your card’s balance, which acts as a loan that you have to pay back and will be charged interest for.

Credit cards typically have a grace period where you can pay off your balance without accumulating interest. This can be a useful way to take advantage of the perks of a credit card, such as point and cashback bonuses, without being charged.

If you carry a balance from month to month, you’ll be charged interest on the balance and have to make a minimum monthly payment as determined by the card carrier. As credit card interest rates tend to be higher than bank loans, it’s a better idea to pay off your balance each month and rely on a loan for larger purchases.

Other types of loans

There are a few other, smaller loan types to be aware of when you’re looking for a way to pay.

- Buy now pay later (BNPL): It is a small installment loan often offered for retail. When using a BNPL provider, you agree to pay back the loan in installments over a series of weeks or months. While the loan itself doesn’t come with interest, missing a payment means getting hit with high late fees and penalties.

- Debt consolidation loans: These are loans that combine several debts into one debt. When you take out the loan, you use the funds disbursed to pay off your debts, and then focus on the balance of the consolidation loan.

- Credit builder loans: These allow you to build a positive credit history by taking out a small balance that you pay back over time, often with the money you borrow, which helps you boost your credit score.

- Balloon loans: These are also known as payday loans, are loans where you borrow a lump sum and pay back all or most of the loan balance by a certain date. These loans tend to be risky, as you have to have all the money you borrowed ready when the payment date arrives. They can also come with predatory interest rates of 50% to 200% APR.

How to choose the right loan type for your needs

With as many loans as there are, finding the right one for your needs is essential. The right loan can make your repayment process easier and help you get the finances you need, while the wrong loan can hinder your budget. Here’s how to choose and get the right loan for you.

Determine what you need the loan for

First, figure out what you need to purchase with the loan. While you’ll obviously use a mortgage for a house or an auto loan for a car, for other costs, you’ll need to narrow down your choices.

Ask yourself these questions:

- What will you use the loan for? Some loans are use-limited, such as business or student loans.

- Do you have collateral to back the loan with? If you do, you’ll be able to get a better interest rate and have better chances of approval.

- How much do you need? For larger amounts, you’ll probably want to go with a standard loan over using a credit card. If you need a loan for an ongoing home renovation project where you’re unsure exactly how much you need to pay, a HELOC or revolving loan can give you more flexibility than an installment loan.

- How quickly do you need the loan? Standard loans generally take longer to approve than a credit card charge.

Once you’ve answered these questions, you’ll have an idea of what type of loan to move forward with.

Calculate your down payment

Many loan types will require a down payment. How much of a down payment you need will depend on the loan type and how much you’re comfortable paying.

- Mortgages generally have a loan minimum of 3%, though putting down 20% or more will help you avoid private mortgage insurance (PMI.)

- Auto loans often come with no-money-down promotions, though experts advise 20% down for new cars and 10% for used cars to account for early depreciation.

- Personal loans and student loans generally don’t require a down payment.

- Business loans generally require 10% to 30% down payment.

Keep in mind that the more you pay down ahead of time, the less your monthly payment will be, the more likely you are to be approved for your loan, and the better interest rate you’ll be offered.

Compare the repayment plan to your budget

Once you have your down payment and loan balance figured out, you’ll be able to calculate your monthly payment. You can use a loan calculator to determine your payment, as well as how long you’ll be paying off your loan for.

It’s crucial to have a monthly payment plan in place before you take out a loan. You should be able to comfortably make the loan payment each month with your current budget. If it’s a tight squeeze, you might want to consider cutting some expenses, taking out a smaller loan, or forgoing the loan altogether.

One important thing to consider is your debt to income (DTI) ratio. Your DTI is determined by comparing your gross income to your total debt repayments. For example, if you make $4,000 a month, and your monthly debt payments are $1,000, then your DTI is 25%.

If your DTI is too high, then lenders may not approve your loan, since you’ll have a hard time repaying your new loan. As a rule of thumb, your DTI should not exceed 36% for the sake of loan approval and your overall financial health.

Compare interest rates and fees

Finally, compare the interest rates and fees available for your loan type. Lenders will typically advertise an APR, which represents the cost of the loan in interest and fees combined.

The lower your APR, the less you’ll pay. Lenders will generally advertise a range of APRs to potential borrowers, as the actual APR of your loan will depend on your down payment, credit history, and other factors.

Some lenders offer preapproval, which allows you to get an APR offer without having to go through the credit check process. You can use preapproval letters from different lenders to compare prices and find the best deal for you.

Integrating loans into your financial plan

Monarch can help you make your loans a seamless part of your budget. With real-time tracking, detailed budgeting, and regular debt reports, you can make finding the right loan for you, and paying it off, a straightforward process.

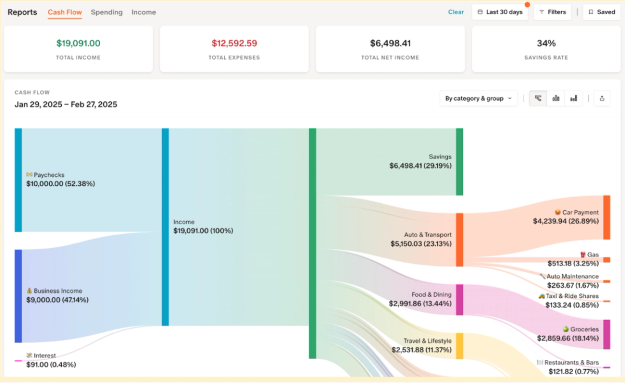

Monarch visualizes your cash flow by tracking your transactions across your different accounts. You can connect accounts with a partner to combine finances, categorize your finances, and get a handle on your expenses.

This way, you can see how much you can afford for your monthly payments, and help find the right loan for you.

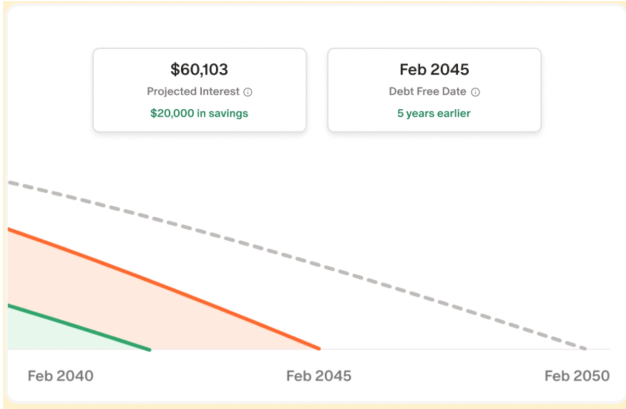

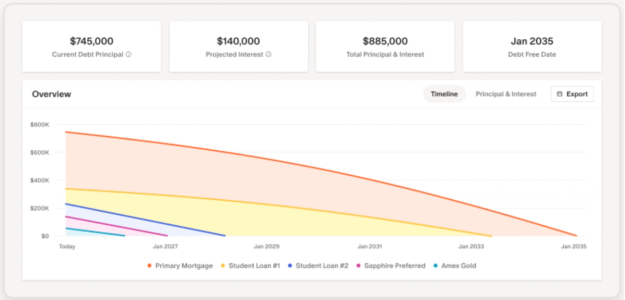

Monarch is also there for you as you pay off your loan, with payoff goals. Not only can you track your loan repayments, but you can track your progress to payoff. Monarch provides you with regular progress reports, forecasts, and a visual overview of your repayment journey with pay down goals.

If you have multiple debts, you can use Monarch’s debt dashboard to get a bird’s-eye view of your total debt, how much you have left to pay, how much interest you’re projected to pay, and your debt-free date.

If you want a detailed way to track your finances, keep an eye on your debt, and manage your payments and balance all in one place, consider trying Monarch today.

Conclusion

When it comes to borrowing money, there’s a huge range of loans available to choose from. From mortgages, to student loans, to auto loans, choosing the right loan for you is a matter of understanding what your needs are and having a good handle on your budget and finances.

Staying on top of your budget is crucial to staying on top of your loan payments. By using Monarch, you can track your finances in real time, watch your debt payoff, and make sure you never miss a payment as you pay down your loans.

FAQs

What are the 2 main types of loans?

The two main loan types are secured and unsecured loans. Secured loans are backed by collateral such as real estate or vehicles, while unsecured loans aren’t backed by collateral. With a secured loan, if you default on the payments, the lender can seize your collateral.

What are the 3 most common loans people get?

The most common loans by debt volume are mortgages, holding 70.3% of total household debt in the United States, followed by auto loans (8.9%) and student loans (8.9%), according to the Federal Reserve Bank of New York.

Can I have multiple loan types at once?

Yes. Many households have a mortgage, an auto loan, student loans and credit card debt. Something to keep in mind is that lenders will look at your debt to income (DTI) ratio. If your monthly debt payments, or your overall debt, is too much compared to your income, you may have trouble getting approved for future loans.

Is it better to get a personal loan or use a credit card?

It depends on what you need to use it for. If it’s for a small purchase that you can pay off in the grace period, it’s faster and less expensive to use a credit card. For larger purchases that you’ll need to pay off over many months, a personal loan will have a lower interest rate and a higher limit.

Related Monarch resources

A Beginner’s Guide To Mortgage Loans

Financial Resolutions for 2026

Saving For Our Dream House Sounded Stressful. Then We Found Monarch.