Avocado toast jokes aside, saving for a home is no easy task. Housing prices hit record levels in 2025, and many potential homeowners fear they’ll never be able to buy a home to call their own.

Don’t despair. With housing prices poised to dip in at least 12 major markets in 2026, buying a house may be in your future. With a smart savings plan and a bit of financial strategy, you can save for your dream home and sign your purchase agreement in no time.

How to save for a house in five steps

Saving for a house, while simple, takes organization and discipline. Here’s a breakdown of the process.

Determine how much you need to save

How much you need to save for a house will depend on how much house you can afford, how many debts you have, and how much of a down payment you want to put down.

First, look at how much you’re willing to spend.

Calculating your monthly payment

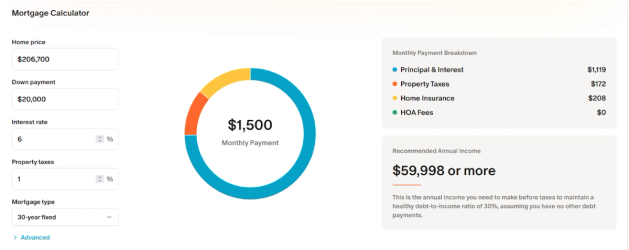

Mortgage lenders generally recommend that your monthly housing payment including principal, interest, taxes, and insurance (PITI) shouldn’t be more than 30% of your gross monthly income.

As an example, let’s say your household brings in $5,000 a month. Your mortgage’s monthly payment, therefore, shouldn’t be more than $1,500.

Calculating how much house you can afford

From there, we can look at how much house you can afford. Assuming you have no other debts, and with an interest rate of 6%, taxes at 1% yearly of the house value, and insurance at $2,500 a year, you can afford a home up to $206,700. You can use a mortgage calculator to fiddle with the numbers and see exactly how much you can afford based on your income.

Calculating your down payment

The next step is determining your down payment. In the example here, it’s assumed your down payment is about 20% of the home price. While many mortgage lenders have a down payment minimum of 3%, a heftier down payment will lower your monthly payment and allow you to afford a more expensive home.

Moreover, if you put down 20%, you’ll avoid something called private mortgage insurance (PMI). You’re required to have PMI if you have less than 20% equity in your home, as it’s riskier for the lender when you don’t have as much equity. PMI usually costs 0.5% to 1.5% of the home’s total value per month, which can quickly add up.

Calculating your closing costs

Finally, it’s important to account for closing costs. When closing on a mortgage, you’ll need to pay various fees to your broker and lawyer, as well as pay for the inspection and assessment of the house.

Closing costs generally cost 3% to 6% of the loan total. In the example we used before, for a $206,700 house, your closing costs, at the upper limit of 6%, would be $12,402.

With a down payment of $40,000, this means you’ll want to save a total of $52,402.

Review your finances and budget

Once you have your savings goal set, it’s time to review your finances and get a budget in place, if you haven’t already. Your budget will inform you how much you can afford to put toward your down payment each month.

Before you start saving for a house, be sure to have a robust emergency fund in place. This way, if you have an unexpected expense, you can use your emergency fund instead of relying on loans or having to raid your house fund.

Once you have that in place, see how much you can afford to put aside. Consider cutting non-essential expenses, and automating your savings so that you don’t have to make a physical deposit each month.

When you have a set monthly amount you’re contributing, you then establish a timeline for your savings. For example, if you plan on setting aside $1,000 each month for your house fund, you can expect to reach your $32,402 goal in roughly two and a half years (32 months.)

Paying off debt before saving for a house

If you have any high-interest debt in your name, such as credit card debt, you may want to pay off this debt before saving for a house. While it’s possible to get a mortgage with existing debt, keep in mind that lenders look at your debt to income (DTI) ratio when approving you for a mortgage. The more debt you have, the less of a mortgage you’ll be approved for.

Moreover, high-interest debt can quickly grow out of control and outpace whatever progress you make in saving for a down payment. Before you begin saving, see how quickly you can eliminate your high-interest debt, and then put your former payments toward your house savings.

Set up a dedicated home savings account

It’s important to keep your house fund in a safe and accessible place, and ideally in a separate account from your regular and emergency savings.

While it may be tempting to invest your house fund in the stock market, or in assets such as gold, you’ll want to keep your fund liquid and relatively insulated from market volatility. Otherwise, you’ll be in a pretty tough spot if the market crashes when you’re ready to cash out on closing day.

Instead, consider parking your savings in a high-yield savings account (HYSA). These accounts offer higher interest rates than traditional savings accounts, while offering the same safety and accessibility. They also often come with no fees or service charges, and have automatic deposits available.

Increase your income

Once you have your savings account set, it’s time to boost your income. The more money you bring in, the more you can put toward your house fund.

With your primary job, see if you can ask your manager for a raise. Taking the time to upskill or get more certifications will give you leverage to ask for a pay increase or, if need be, negotiate a better salary at a different job.

Besides increasing your primary income, see if you can take on a side hustle. These can include:

- Ridesharing for Lyft or Uber

- Food and package delivery

- Taking on a second shift as a server, bartender, or clerk

- Selling homemade goods at fairs

- Tutoring

- Pet sitting or dog walking

- House sitting

- Freelancing

- Selling items on eBay or Etsy

- Monetizing a content channel on YouTube, Instagram or TikTok

Keep an eye on interest rates

Interest rates will be one of the key factors in determining how much your loan will cost. The lower your rate, the lower your monthly payment, and the more house you’ll be able to afford.

Mortgage interest rates follow the benchmark rate that is set by the Federal Reserve, which raises and lowers the rate based on the country’s overall economic health.

While mortgage rates aren’t always strictly in line with the Fed’s rate, if the rate has dropped, you may want to consider shopping for mortgage offers to see what rate you’ll be offered. You may find that rates have dropped in the meantime, and that you don’t need as high a down payment as you initially calculated.

Smart saving hacks

There’s more to saving than finding change in your couch. Here are some quick hacks to supercharge your savings and get you to the finish line faster.

- Automate your savings: Saving in the background will take the pain out of making transfers. If you can have it come directly from your paycheck, you’ll be less tempted to spend it.

- Slash your current housing costs: If you’re renting, move to a cheaper location, take on roommates, or move in with family.

- Implement a go-slow week: Spend one week a month seeing how far you can go with not spending. Clear out your pantry instead of shopping for new food. Watch old films instead of going out. Take a walk instead of driving to the corner store.

- Improve your credit score: Boosting your credit score can help you snag a better interest rate on your mortgage, and lower other payments like your insurance premiums.

- Buy in bulk and on sale: Keep an eye out on when stores discount items close to their expiration date, and invest in a freezer so you can stock up when perishables go on sale.

- Hit up your local library: Besides books and DVDs, many libraries offer subscription passes, discount tickets to local attractions, and games and toys to borrow.

- Get good with DIY: Changing your own oil or learning to fix a clog in your sink can save you big bucks on maintenance costs.

Take advantage of first time home buyer programs

First-time home buyer programs can give you a leg up in saving for a house. These programs often have reduced down payment and credit requirements, and are backed by both federal and state governments.

Here are some first-time home buyer programs to consider.

- Federal Housing Authority (FHA) loans: These are backed by the federal government, and offer relatively low interest rates with a 3.5% minimum down payment for a credit score minimum of 580.

- The Housing Choice Voucher homeownership program: It is available if you’re already on housing vouchers. This program offers assistance for making payments on your first home, and is available to low-income buyers.

- Veterans Association (VA) loans: These are available for eligible US veterans and offer low down payments, down payment assistance, and other ways to help you buy your first home.

- US Department of Agriculture (USDA) loans: These are available for buyers in eligible rural areas for single-family homes.

- State and local programs: These programs offer down payment assistance, subsidized down payment programs, and vouchers or discounts for eligible participants.

When looking for a first-time home buyer program, visit your local housing authority and see what you qualify for.

Track your progress as you save for a house

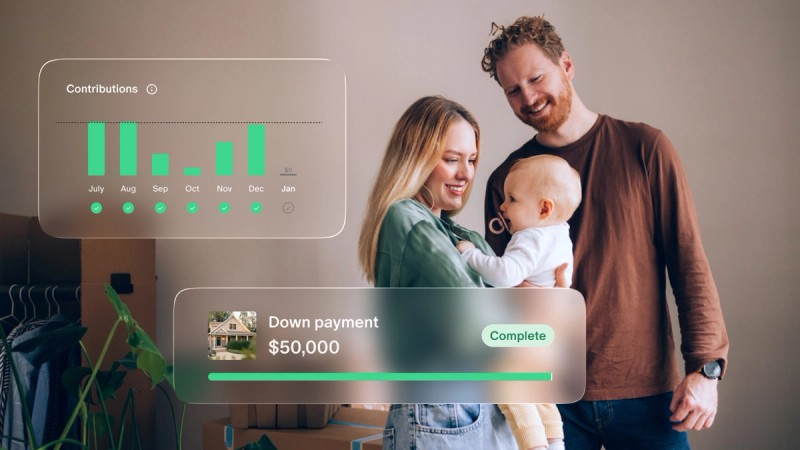

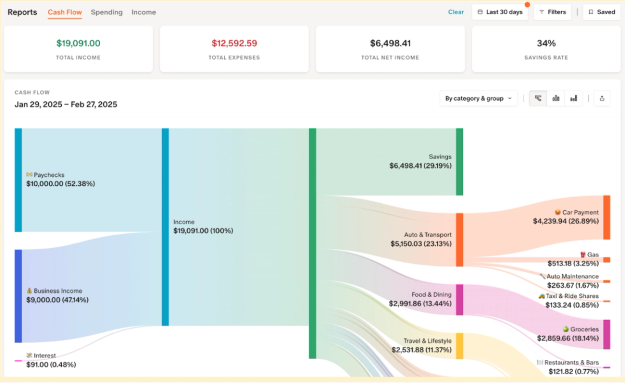

Saving up to buy your first home can be a long journey. With Monarch, not only can you track your progress in real time, but you can also get a pulse on your cash flow, see where you can put your money to best use, and speed up your saving journey.

With a real-time tracking system, you can get a detailed view of your budget simply by plugging into your accounts. Monarch categorizes your transactions based on rules and tags you set, saving you time on manually tracking your expenses.

You can use your data to create an actionable budget with room to save, and combine your expenses and savings with a partner in the program.

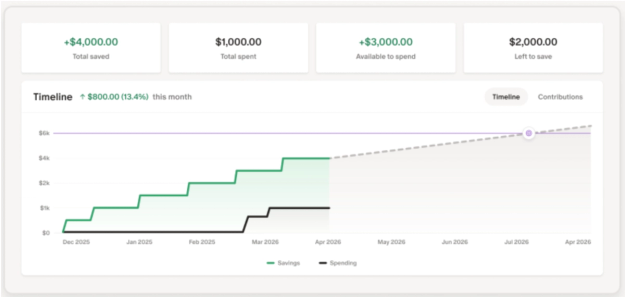

Monarch can help you get a handle on your house saving progress with saving goals. Savings goals allow you to track your savings in real time, and calculate your timing based on how much your contributions.

You can compare your savings goals with other goals you have set for retirement and loan payoffs, and prioritize your savings based on your circumstances. Monarch generates monthly reports based on your savings and helps you keep a pulse on your savings progress.

Finally, Monarch offers features for working with your financial advisor on your budgeting and saving directions.

When you’re finally ready to buy a home, Monarch is there for you again, helping you track your housing payments and recording your progress with your mortgage as you pay it down.

If you want to simplify your savings, get a pulse on your budget and get real-time tracking, reporting, and advice on your overall financial picture, give Monarch a try today.

From saving to homeownership

Saving up for a house deposit might seem impossible. However, homeownership doesn’t have to be unattainable. By planning out your down payment and closing costs, creating and sticking to a budget, boosting your income, and saving the smart way, you can reach your goal of buying your first home.

Monarch is with you every step of the way. With detailed reports, real-life transaction tracking, and goal setting, you can use Monarch to help you achieve your homeownership dreams.

FAQs

How long will it take to save for a house?

That will depend on how much you plan on saving each month, and how much you need to save. For a 3% down payment on a $200K house ($6,000) on an income of $80,000, saving 10% each month would take you about nine months. For a 20% down payment ($40,000), it would take five years.

How much of my income should I save for a house?

Experts recommend saving at least 20% of your income each month in general, which you can put toward your house savings. If you cut down on your non-essential expenses, you can save even further.

Should I invest my house savings?

No. While investing your savings might get you a good return, you want to keep your savings relatively stable and intact for when you need to withdraw it. Not only do stocks take time to sell, but if the market is low when you sell, you may end up losing some of your initial funds.

Can I use my 401(k) or IRA to help with a down payment?

While you can, it’s not a good idea. Raiding your retirement fund before you retire can cost you hundreds of thousands of dollars in potential compounded funds later down the loan. Moreover, withdrawing early comes with tax penalties and fees. You’re better off saving the slow way.

Related Monarch resources

Saving For Our Dream House Sounded Stressful. Then We Found Monarch

Financial Resolutions for 2026