When it comes to saving for retirement, you have a few options when choosing where to park your money. An individual retirement account (IRA) and a 401(k) act similarly in terms of how they help you save for retirement and allow your savings to grow to keep pace with inflation.

When it comes to IRAs and 401(k)s, here are a few key differences to be aware of when choosing how to save for your golden years.

The good news is that you don’t have to choose between one or the other. In fact, many experts recommend having both an IRA and a 401(k), which allows you to take advantage of the benefits offered by both and diversify your retirement investment accounts. Here’s what to know about maxing out your retirement saving strategy.

Key Takeaways

- 401(k)s are employer-supported retirement accounts with high limits, contribution matching, and less-flexible investment options.

- IRAs are independent investment accounts with lower limits and a wider range of investment options.

- Both investment accounts offer advantages and disadvantages, and it’s a good idea to use both to maximize your retirement savings.

Retirement Account Basics – IRA vs 401(k)

It can be easy to get an IRA and 401(k) mixed up. To start, let’s dive into what each account is, how it works, and the key features that make them unique.

What is an IRA?

An IRA is an individual retirement account offered to individuals and their spouses. Because it is an individual account, an IRA isn’t sponsored by an employer, but instead owned and operated by an individual, though it can be managed by a third-party administrator who handles the investment and tax details.

There are a variety of IRAs available, with different limits, conditions, and dispersal methods. Some of the basic ones include:

- Traditional IRAs. This type takes pre-tax contributions, with withdrawals being taxed. Anyone can open one.

- Roth IRAs. Account holders make post-tax contributions, in exchange for withdrawals being tax-free. These are limited to individuals below a certain income threshold.

- Rollover IRAs. These accounts allow you to roll over funds from a 401(k) to an IRA without penalty fees, which is useful if you ever leave your employer’s plan. These can be either traditional or Roth, depending on which type of account you rolled the funds over from.

- Inherited IRAs. These IRAs are a way for beneficiaries to receive inherited funds from a benefactor’s retirement accounts, such as a 401(k).

IRA investments are handled by a trustee or custodian such as a bank, financial institution or brokerage, meaning that you have a wide variety of investments to choose from that aren’t limited by your employer’s selection.

In general, anyone who has earned income in the United States and their spouses can open an IRA account, and you can have as many IRA accounts as you want to. It can be a helpful way to roll over funds from an old employer’s account in order to avoid fees and have more control over your investments.

Like 401(k)s, IRAs come with annual contribution limits. For 2026, the contribution limit for traditional and Roth IRAs is $7,500, with an additional $1,100 catch-up contribution if you’re over 50. Also like 401(k)s, withdrawals can only be made at age 59½, and otherwise incur a penalty fee with few exceptions.

The key features to know about an IRA are:

- Individually-owned and managed retirement account

- Wider variety of investment options

- Penalty fee if withdrawn from before age 59½

- Contribution limit for 2026 is $7,500 with $1,100 catch-up contribution for for traditional and Roth

What is a 401(k)?

A 401(k) is a retirement account offered to employees by employers that allows individuals to save part of their salary in a designated retirement account.

Employees set the contributions they make out of their salary, and it is deducted out of their paycheck with each pay period. Employers may offer something called 401(k) matching, where they will make a payment into the account equal to the employee’s contribution up to a certain amount, helping the employee save even more. They may also offer other incentives such as profit sharing contributions, which is a flat contribution to the account.

The funds deposited into the account are used for investments that will grow over time. These investments are typically handled by a third-party administrator who will select a range of investments such mutual funds and stocks as selected by your employer. While you can choose which funds to invest in, you don’t have to take an active role in choosing your portfolio if you don’t want to.

One of the key benefits of a 401(k) is that it is tax-advantaged. Depending on the types of account, you may be able to make pre-tax contributions with your withdrawals being taxed, or make post-tax contributions with your withdrawals being tax-free. Either way, you can save on taxes either when you withdraw or contribute.

Since it’s a retirement account, you can only start making withdrawals at age 59½. Otherwise, with a few exceptions, you will be charged a 10% early withdrawal penalty.

Finally, 401(k)s come with contribution limits as set by the IRS. The contribution limit for 2026 is $24,500, with an additional $8,000 in catch-up contributions if you are over age 50.

The key features to know about a 401(k) are:

- Offered by employers to employees

- Contributions can be made pre or post-tax, depending on type

- Employers can offer contribution matching or flat contributions

- Penalties if withdrawn from before age 59½

- Often managed by third-party administrators

- Contribution limit for 2026 is $24,500 and $8,000 for catch-up contributions

IRA vs 401(k) – Key Differences

Now that we’ve gone over what an IRA, a Roth IRA, and a 401(k) are, here are the key differences between the three to know about. Don’t have time to read? Here’s a handy table.

Category | 401(k)s | IRAs |

Tax benefits | Contributions can be made from pre or post-tax income, depending on the type | Contributions can be made from pre or post-tax income, depending on the type |

Contribution limits | $24,500 for 2026, with an additional $8,000 in catch-up contributions | $7,500 for 2026 with $1,100 catch-up contribution |

Employer contributions | Yes | No |

Investment options | Limited to employer options | Wider variety based on brokerage |

Withdrawals | Can be taxed or not taxed, depending on the type | Can be taxed or not taxed, depending on the type |

Required minimum distribution | Required at age 73 | Can be required or not required, depending on the type |

Eligibility | Available through employer accounts | Available to anybody who has earned income in US, with some restrictions based on type |

Protection from creditors | Unlimited protection | Protected up to $1,711,975 |

Inheritance | Inherited account must be rolled over into IRA | Account can be directly inherited and transferred |

Here are the key differences in more detail.

Tax Benefits

IRAs and 401(k)s both come with tax benefits, though they’re applied a bit differently, depending on the type of account.

- 401(k) contributions can be made pre or post-tax, depending on the account type.

- Traditional 401(k) contributions, for example, pre-tax, which gives you more income to contribute and lowering your taxable income for the year, which can lower your income bracket and your tax rate. However, your withdrawals will be taxed, which can be disadvantageous if the tax rate increases by the time you retire.

- Roth 401(k) contributions, on the other hand, are made post-tax, with your withdrawals being tax exempt after you retire.

- IRA contributions can also be made pre or post-tax, depending on the account type. For example, Roth IRA contributions are made post-tax, while traditional IRA contributions are made pre-tax. For IRA accounts where you make your contributions pre-tax, your withdrawals aren’t taxed, and vice-versa.

Contributions and Limits

Both types of retirement accounts have a contribution limit as set by the IRS. For the 2026 fiscal year:

- 401(k) contribution limits are $24,500, with an additional $8,000 in catch-up contributions if you are over 50.

- IRA contribution limits are $7,500 for traditional and Roth IRAs, with an additional $1,100 catch-up contribution if you’re over 50. Depending on the account type, you may have your contributions capped based on your income.

Employer Matching Contributions

One of the key differences between a 401(k) and an IRA is the option of employer contributions.

- 401(k) plans often have employer contribution incentives. Matching incentives, for example, have your employer match your contributions up to a certain percentage of your gross income, such as 5%. Some employers will make a flat contribution as a profit sharing incentive, without the need for employees to make a contribution to match.

Either way, employer contributions don't count toward your contribution limit, making it a speedier way to save. - IRAs, on the other hand, don’t have employer matching.

Investment Options

Another key difference between a 401(k) and an IRA is your investment options.

- Investing with a 401(k) somewhat limits your investment options. While you have control over your specific investments and your investment strategy, your options are generally limited to what your employer has chosen for investments, though some employer plans will offer options for a “self directed” account where you have more investment options to choose from.

- Investing with an IRA generally gives you a much wider variety of options, since you can select your brokerage and you have more stock and portfolio options available to you.

Withdrawals and RMD Rules

With both a 401(k) and an IRA, the government doesn’t want you to make withdrawals before you hit your retirement age. While there are exceptions based on hardships and special circumstances, in general, withdrawing before age 59½ from either type of account will come with a 10% penalty, with exceptions made for certain circumstances.

Something else to keep in mind are required minimum distribution (RMD) rules.

- A 401(k) requires you to make a yearly minimum withdrawal from your account once you reach age 73.

- Some IRA accounts, like a traditional IRA, require you to make a yearly minimum withdrawal from your account once you reach age 73. Others, like a Roth IRA, don’t.

Eligibility and Accessibility

Traditional IRAs, Roth IRAs and 401(k)s have different rules for eligibility and contributions.

- With a 401(k), you can only create an account and make contributions through an employer. If you leave the job, are fired, or laid off, you can no longer make contributions, and you may incur a fee from the account administrator for managing your investment. You can still adjust your investments, however, or move your fund by transferring the money to a rollover IRA.

- Generally, IRAs are available to anyone who wants to open one, as long as they or their spouse have earned income in the United States. Some IRA types, like Roth IRAs, are available only to those who fall below the income threshold, which dictates how much you are able to contribute each year.

Protection from Creditors

If you ever have to file for bankruptcy, or have to put your assets on the line to pay a loan or unpaid taxes, your 401(k) and your IRA will be impacted differently.

- 401(k)s are generally protected during the bankruptcy process, with no limits on size or monetary value.

- IRAs are protected up to a maximum of $1,711,975 as of 2026.

Inheritance

Inheritance is also different between 401(k)s and IRAs.

- If a spouse or beneficiary inherits a 401(k), they will have to roll over the funds into a spousal or inheritance IRA in order to access it.

- With IRAs, however, the beneficiary can simply transfer ownership to themselves if they are a designated inheritor.

Pros and Cons of 401(k)s and IRAs

With their differences and unique qualities, there are pros and cons to consider for both 401(k) and IRA retirement accounts.

Pros and Cons of a 401(k)

Here are the positives of a 401(k) to consider.

401(k) Pros:

- Employers often offer contribution matching or profit sharing

- Higher limits than an IRA

- Unlimited protection from bankruptcy and creditors

Here are some of the downsides of a 401(k) to keep in mind.

401(k) Cons:

- Only available through employer plans

- Withdrawals are required past the age of 73

- Fewer options for investments

- Cannot be directly inherited

Pros and Cons of IRAs

Here are the positive aspects of an IRA to consider.

IRA Pros:

- More control over investments

- Doesn’t require an employer plan

- Can be directly inherited

Here are some of the negative aspects of an IRA.

IRA Cons:

- No employer contributions available

- Lower contribution limits than a 401(k)

- More limited protection from bankruptcy and creditors

- Some account types are income-limited

Should You Use a 401(k), an IRA, or Both?

Keep in mind that an IRA and a 401(k) are not mutually exclusive. You can keep and contribute to both accounts at the same time. The question lies in how you want to prioritize your contribution.

Many experts recommend, if possible, you max out both types of retirement accounts, as they are tax-advantaged ways to save and invest for retirement, and can give you more of a financial cushion in your retirement years.

If you don’t have extra funds to spare, here’s how to allocate your contributions.

Prioritize Your 401(k) If:

- Your employer offers contribution matching. This is basically free money being left on the table, so take advantage of it if you can.

- You don’t qualify for a Roth IRA. As Roth IRAs are income limited, if you don’t have that option, see about focusing on your 401(k) instead.

- You have options for a post-tax option in your 401(k). Some 401(k) types, like a Roth 401(k), allow you to make post-tax contributions with all the advantage of a 401(k), like unlimited bankruptcy protection and employer contributions.

Prioritize Your IRA If:

- You don’t have a 401(k). If you’re self-employed or your employer doesn’t offer a 401(k), an IRA is a key part of your retirement plan.

- You’ve maxed out your 401(k) employer contribution. Once you’ve taken the money off the table, you can start directing your payments to an IRA.

- You have investments you want to prioritize in your IRA account. Since an IRA gives you more investment options, if there’s something you want to focus on in your portfolio, focus your contributions there.

- You expect to be in a higher income bracket when you retire, and you don’t have a Roth or post-tax option in your 401(k) plan. A Roth IRA in particular has tax-free withdrawals, which can save you more on taxes if you’ll have a higher tax rate in retirement.

As always, if you’re unsure about how to allocate your savings, talk to a financial advisor and see what’s best for your goals and income.

Maximizing Your Retirement Strategy – Using 401(k) and IRAs Together

According to a 2025 Bankrate survey, 34 percent of American workers feel they’ll need $1 million in their savings in order to retire. With federal projections of Social Security funds running out between 2033 and 2034, having enough personally saved to retire is more essential than ever, which is why maxing out both account types can be to your benefit.

Of course, you should only do this after prioritizing your day-to-day expenses, your emergency fund, paying off high-interest debt, and other more immediate savings goals you have for yourself.

If you want to maximize your savings, take the following steps:

- Maximize your 401(k) contributions up to your employer’s contribution matching.

- Open an IRA, if you don’t have one, and direct the remainder of your funds to maxing out the yearly contributions.

- Once you’ve hit your IRA limit, focus on contributing to your 401(k) again.

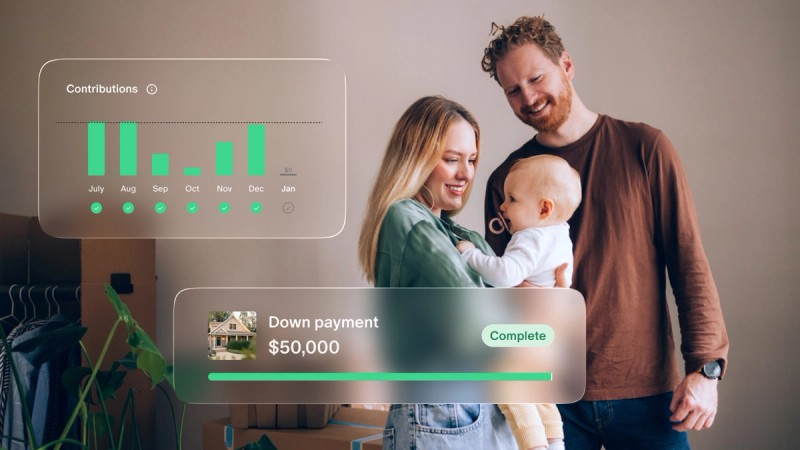

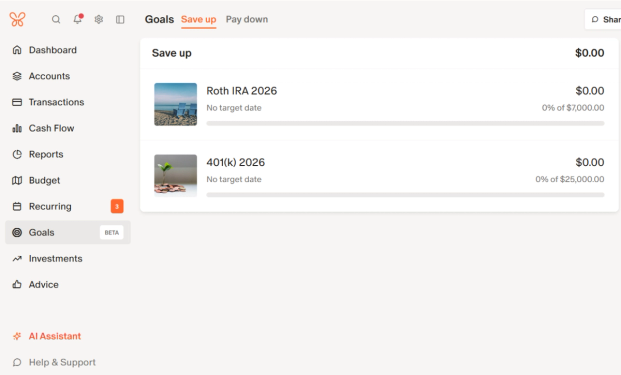

Automating your contributions directly from your paycheck can help you save seamlessly. Monitoring how much you have saved is essential to hitting your goals and avoiding going over your contribution limits. This is where Monarch comes in.

How Monarch Can Help You Optimize Your IRA and 401(k)

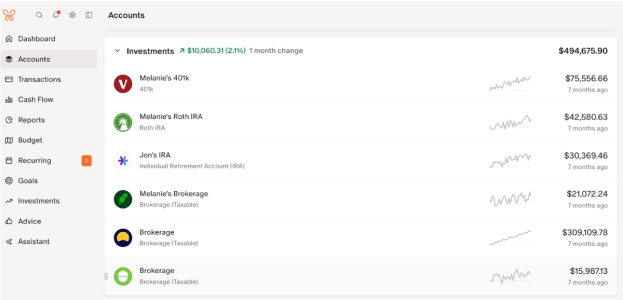

Keeping track of your retirement funds and contributions can be tricky, especially if you have multiple accounts from job hopping, old 529s, and otherwise. Monarch gives you an all-in-one platform to help you get a bird’s eye view of your retirement savings journey and helps you make informed decisions about how you want to save.

Monarch allows you to connect retirement accounts across different brokerages and administrators, giving you a holistic view of your savings instead of having to juggle multiple account logins. Monarch logs month-over month changes, showing you how your investments grow over time and allowing you to track your contributions.

Your investment accounts also contribute to your net worth, which you can track in Monarch’s main dashboard, along with accounts you choose to link with a partner or spouse.

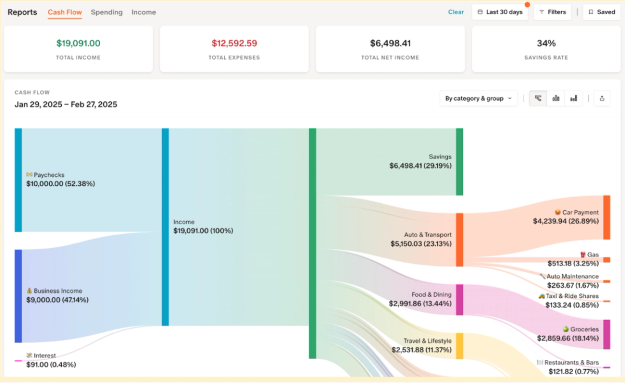

If you’re falling behind on your contributions, Monarch can help you by allowing you to analyze your budget and see where the gaps are. If you’re spending too much on DoorDash, or need to rein in some subscriptions, Monarch can tell you at a glance. Just plug in your saving and spending accounts, set your categories, and see where you can tighten up your spending and allocate it to your nest egg.

Finally, Monarch offers goal tracking, which allows you to set your retirement contribution goals and track them based on your contributions and automatic deductions from your paycheck. This way, you can watch your progress to maxing out each account and make sure you don’t go over the limit.

If you want a holistic, detailed, and inclusive way to track your retirement savings accounts and hit your goals this year, consider giving Monarch a try.

Conclusion

While different, using IRAs and 401(k)s together can be a powerful way to maximize your retirement savings in a tax-advantaged way. A 401(k) can help you take advantage of employer contributions, while an IRA can offer more control over your investments, and tax-free withdrawals through a Roth IRA account. Using Monarch to get a handle on your savings can help you track your goals in real time and allow you to maximize your savings for the future ahead.

FAQs

Can I contribute to a 401(k) and an IRA in the same year?

You can, so long as they’re within the contribution limits for each type of account. How much you contribute to either type of account doesn’t affect the other, and if you have the means to, you should max out your contributions to both.

What if I max out my 401(k) – should I still invest in an IRA?

You should. Contributing as much as you can to both accounts will give you more income to work with when you retire. The more you save, the more your investments will compound.

What happens to my 401(k) if I leave my job?

Your account will still exist and grow with its investment, though you can’t contribute to it. You can leave it as is, though it may incur fees from the administrator. You can also roll it over into a rollover IRA in order to keep contributing to it. Finally, you can withdraw the funds, though this will incur a penalty fee.