The best financial guidance helps you understand what's happening, why it matters, and what to do next….without making you do the heavy lifting.

That's the vision behind our latest release: to give you professionally-guided intelligence that looks after your finances, surfaces what matters most, and helps you plan ahead with confidence. From AI-powered insights to smarter goal planning to a complete view of your equity compensation, we’re dropping several new features designed to help you get ahead in 2026.

Meet your new AI Assistant

What if you had a financial expert who knew your complete financial picture and could answer any question, anytime? That's exactly what Monarch's AI Assistant does.

Your new AI Assistant isn't built from a single point of view or a black box algorithm. It's shaped by the collective wisdom of Monarch's panel of financial experts: CFPs, CFTs, PhDs, and financial coaches who have spent decades helping thousands of people navigate real financial decisions. These experts have helped inform the financial best practices, philosophies, and guidance that was used to train Monarch’s AI Assistant, in addition to reviewing and improving hundreds of questions and answers to ensure you’re getting answers that are clear, credible, and helpful.

The result? An AI Assistant that demonstrates professional level expertise, providing answers grounded in your unique financial picture.

Ask anything, get expert-informed answers

Whether you're wondering about a specific transaction, trying to understand a spending pattern, or thinking through a bigger financial decision, your AI Assistant is there to help.

Some examples of what you can ask:

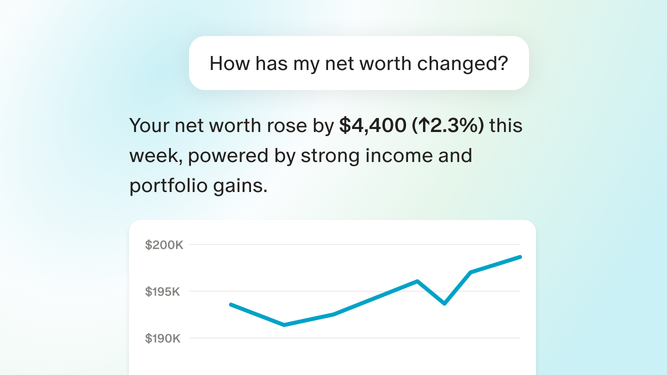

- "Why did my net worth change this month?" Get a breakdown of what drove the change. Not just a number, but the story behind it

- "How should I approach paying off my debt?" Explore different strategies from the avalanche to the snowball method, based on your actual debts and monthly expenses

- "What did I overspend on?" Surface spending patterns you'd miss on your own, with context about why they matter

- "How much am I spending on groceries compared to last year?" Understand trends over time without manually digging through months of transactions

Your AI Assistant understands your full financial picture and helps you make sense of it, anytime you need.

Never miss what matters

How often do you review your finances and wonder if you missed something important? New insights found throughout Monarch solve that by surfacing patterns, changes, and opportunities, so you can stay on top of things without living in the details. Just tap on the "sparkle" icon on select dashboard widgets as well as on the Accounts and Transaction pages to see instant, contextual insights.

You'll see insights like:

- Unusual spending in a particular category

- Net worth changes and what drove them

- Opportunities to optimize and save

Our goal is simple: to surface what matters most so you don’t have to stay in the weeds every day.

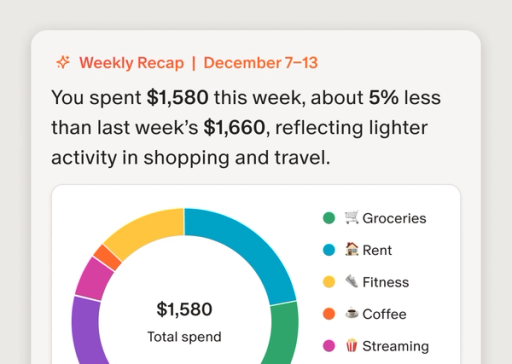

Your Weekly Recap: We handle the details, you get the highlights

Every week, Monarch compiles a personalized summary of your financial activity: what changed, how your spending is trending, and what deserves your attention. Think of it as your weekly financial check-in, delivered automatically. Ask any follow-up questions you have, and your AI Assistant will be there to help with answers.

You can find your latest weekly recap on your dashboard, and we’ll send you a weekly email as well.

Help your AI Assistant help you better

The more your AI Assistant knows about your household, like your ZIP code, dependents, or employment situation, the better it can help you make decisions that fit your circumstances.

You can add these details anytime on the members page of your household settings, and your AI Assistant will use them to give you more relevant guidance.

Our commitment to privacy

Privacy and data security is our top priority and a promise we will continue to uphold. That commitment extends to every new feature we build, including those that leverage AI.

To help answer any questions you may have about how AI is used in Monarch, we have an article dedicated to the topic here.

Goals, reimagined

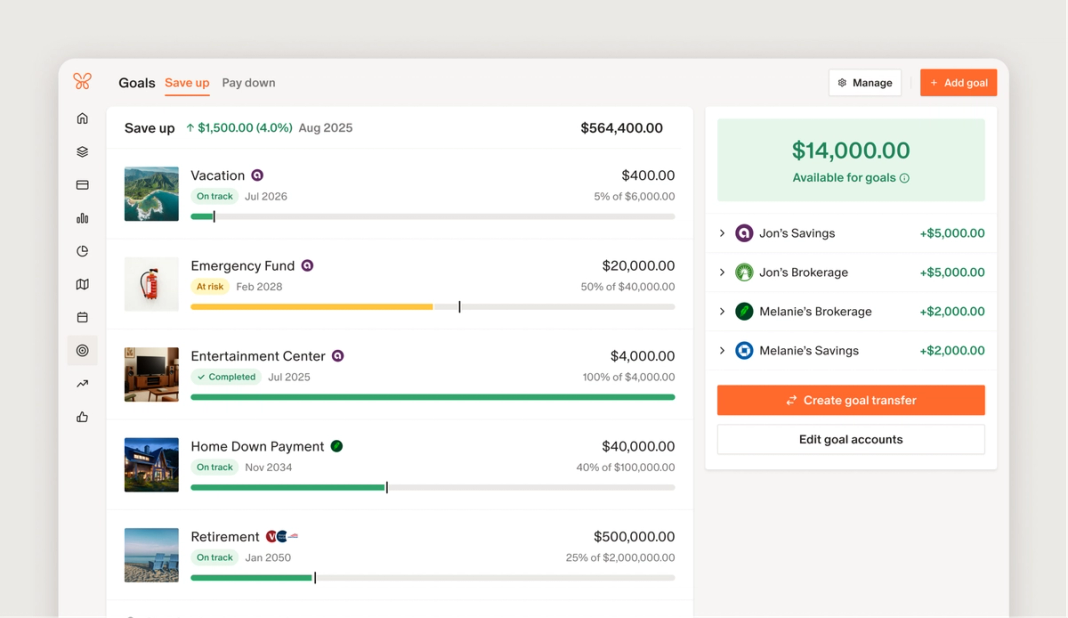

We've completely redesigned Goals around a simple insight: saving money and paying down debt require different planning approaches. That's why you'll now see two distinct experiences—save up goals and debt pay down goals—each tailored to what you're actually trying to accomplish.

Save up goals help you build toward what matters most: emergency funds, down payments, vacations, or any other target. Set your amount and timeline, and Monarch will show you what it takes to get there.

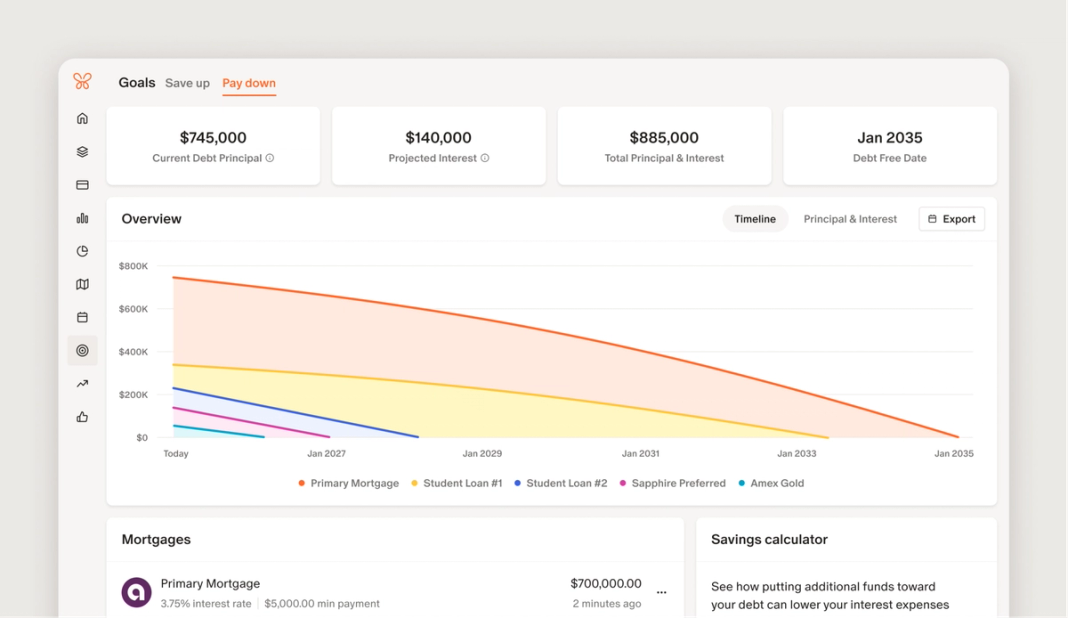

Pay down goals are built specifically for managing credit cards, loans, and other liabilities. Compare avalanche versus snowball methods, model different payment scenarios, and see exactly how extra payments accelerate your path to being debt-free.

Beyond separating these experiences, we've rebuilt Goals from the ground up to be more intuitive, more actionable, and more aligned with how you actually manage money.

You'll always know if you're on track

No more guessing whether you're saving enough. Set a target amount and date, and Monarch calculates exactly how much you need to save or pay each month. You'll see your status at a glance—"On track," "Ahead," or "At risk"—and if life changes, simply adjust your contribution, target date, or target amount to immediately see how it affects your timeline.

Flexible funding from any account

We’ve introduced more flexibility in how you allocate funds from your accounts to your goals, addressing a common pain point in the previous Goals experience. Fund one goal from multiple accounts, or use one account to fund multiple goals, all available for easy reference in a new sidebar view. You’ll also have the option for goal balances to update automatically when an account balance changes.

Spend from your goals as you go

Saving for a vacation? Or house projects that you’re chipping away at? You can now spend from your goals, including spending on a credit card. We'll then automatically reduce the goal balance to reflect that spending as it happens.

Coming soon

As we move out of beta early next year, you'll see additional improvements like the ability to re-order goals in your list, more robust transaction linking, and automated rules to make goal management more effortless.

How to get started

Next time you visit your Goals page on web, you'll see an option to update to the new experience. We'll walk you through adding a few details to migrate your existing goals. If you'd prefer to wait until we're out of beta, you can stick with the current version for now.

For additional guidance on how to use the new Goals feature, check out this video!

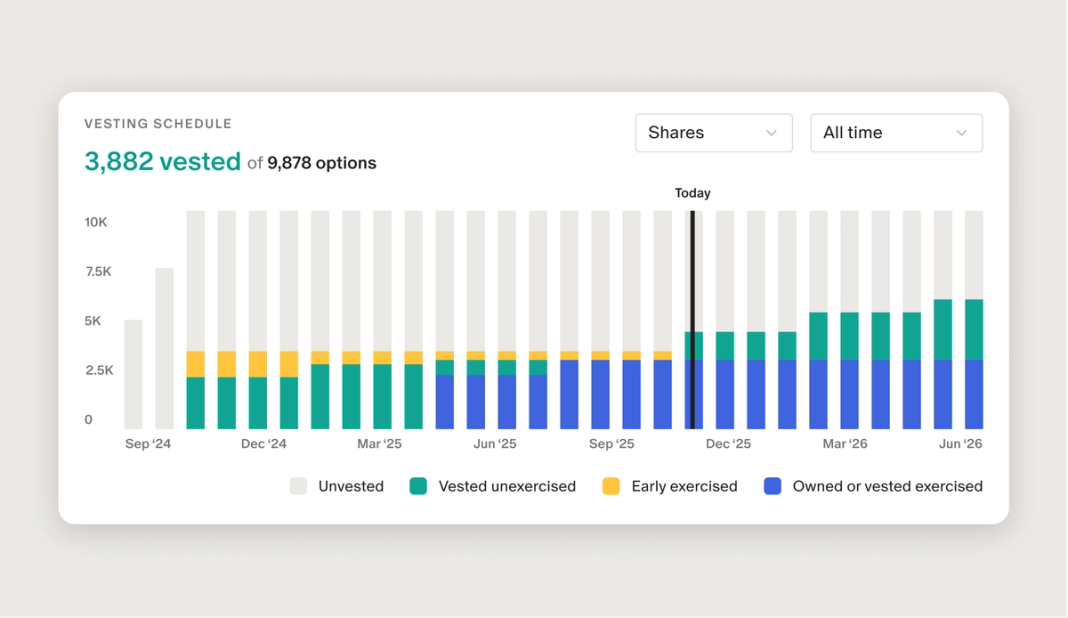

Equity compensation, now in the mix

If you have RSUs, stock options, or other private company equity compensation sitting in a spreadsheet or in other tools, it's hard to know how it fits in within your full financial picture.

Now, you can add equity accounts directly in Monarch to get an accurate picture of your net worth today and see how future grants will vest over time.

You can add RSUs, ISOs, NSOs, and RSAs directly in Monarch alongside all your other accounts. The new account details page shows what's vested, what's coming, and when, so you can monitor the value and growth of your equity for net worth calculations and cashflow planning.

To get started: Head to the Accounts page (on web), select “Add account,” then “Company equity”. You’ll have the option to upload a document to import equity details automatically, or enter grant details manually. More detailed instructions can be found here.

What's coming: We'll continue to enhance what you can do with Equity Tracking, including enhanced reporting, scenario modeling, mobile support and integration with the new AI Assistant for personalized equity insights.

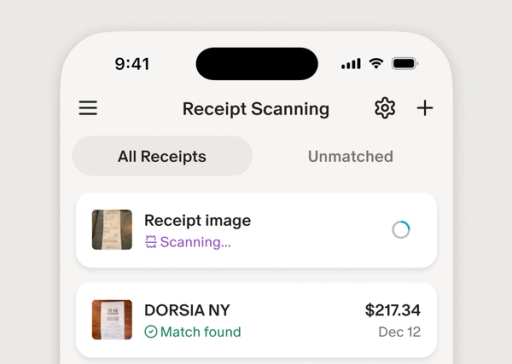

Introducing: Receipt Scanning

Ever look at a transaction and wonder what you actually spent that money on? The Monarch Extension helps solve that for specific retailers (Amazon and Target) and now there’s a new way to get this level of detail in Monarch for any merchant by simply uploading a photo of your receipt.

With our new Receipt Scanning feature, you’ll just upload a photo of a receipt and Monarch will automatically attach it to the right transaction, complete with detailed notes about what you purchased.

Even better: Monarch can split one generic transaction into multiple, properly categorized ones. That Costco run that shows up as a single $147.83 charge? We'll break it down into groceries, household supplies, and electronics—each categorized correctly so you see a more accurate reflection of your spending.

How it works:

- Upload an image in one of three ways from your mobile app:

- By clicking on Receipts in your mobile app's left navigation panel

- From the "+" icon at the top of your transactions page

- Using the share option from a photo in your photo library (you’ll see a new option to share with Monarch)

- Monarch will scan the receipt, find a match, and split and recategorize as needed. We'll also add details to the notes section and attach an image of the receipt itself.

- If Monarch doesn't immediately find a match, you can leave it as "Waiting for match" and we'll keep searching as new transactions sync. You can also match it yourself or create a new transaction.

- Easily review transactions with scanned receipts using the "Receipt Import" tag

You can choose to disable automatic splitting from the settings within the feature if you only want notes and a receipt attached.

Note: digital receipts can also be imported by simply taking a screengrab and following the same steps as above. In the future, we’ll be adding a way to forward email receipts so stay tuned!

What's next

We have a lot planned for next year, all focused on helping you plan what's next with confidence.

One of the next big features you'll see from us is forecasting, and the team is already hard at work on it. This will take you beyond individual goals and help you build a complete picture of your financial future. You'll be able to map out major life transitions, explore different scenarios, and see how today's decisions ripple into tomorrow. Want to know if you can afford a career change? When you might retire? What trade-offs different paths require? Forecasting will help you answer those questions with confidence.

We're building Monarch to be the partner that gives you clarity on where you stand and confidence in where you're headed—whether you're planning for the next year or the next decade.