As a couple, whether you’re married, engaged, or simply in a long-term relationship, it’s important to talk openly and honestly with your partner about the financial goals that matter to each of you so that you can come up with a plan together for how you’ll reach them.

According to an Ipsos survey, one in three (34%) of Americans in relationships said money was a point of conflict in their partnership.

Creating a financial plan as a couple enables you and your partner to align on what you want to accomplish in your lives, and empowers you to make progress as a team. And bonus: When you’re working toward shared goals, it can help you both get (and stay) on the same page with your budget, too.

Whether you decide to keep accounts separate or combine them, you can still work towards shared financial goals. Below, we walk through the key steps involved in building a financial plan that will empower you to work toward your goals and continually improve your overall financial health.

What is Financial Planning for Couples?

Financial planning for couples is the process of building out a long-term map for your finances, including budgeting, setting spending limits, establishing goals for saving and paying down debt, how you want to pay bills and share income, reviewing money habits, planning how to manage risks, and ultimately deciding what you want your financial future and legacy to look like.

Why Financial Planning Matters for Your Relationship

Planning out your financial roadmap with your partner is essential to long-term financial and relationship health. Your finances impact your quality of life, your career options, where and how you want to live, and how your family grows and operates, all of which, if you have a long-term partner, you’ll likely plan on sharing in the future.

Sitting down for a money talk might not seem romantic. However, getting on the same page about your finances early on can help prevent conflict later in the future, and help you establish and work toward your goals sooner.

Financial health is also directly correlated to your relationship health. Couples who discuss their finances regularly are more likely to say that money isn’t the greatest point of conflict in their relationship, according to a Fidelity survey.

Planning is essential to your finances and your relationship. Here’s how you can make it work for you.

Financial Plan vs. Budget: Understanding the Difference

Before diving into the steps for creating a financial plan, it’s first important to understand that a financial plan is not the same thing as a budget. Your budget and financial plan should inform each other, but they are different things with distinct purposes.

Generally speaking, a budget is a tool to help you understand and prioritize how you and your partner are currently spending money. It’s a short-term tool to make sure that you have the money necessary to cover your expenses and save towards your goals. With this in mind, most people budget on a weekly or monthly basis.

A financial plan, on the other hand, is meant to act as a roadmap for your life. It considers your starting point (where you are today) and your ideal destination (the financial goals that you want to achieve) and lays out a realistic plan to get you from Point A to Point B. This plan will likely involve managing your spending and saving with a budget, but it will also consider things like how you might grow your money through investments and how you might protect your finances with insurance. Ultimately, financial planning gives you and your partner a vision for where you’re headed so that you can have clarity on what actions to take today to make progress.

How to Create a Financial Plan Together in 6 Steps

Now that we’ve clarified the difference between a budget and a plan, let’s break down how to set up a financial plan with your partner:

Step 1. Start with Money Conversations

Grab your favorite drink and some romantic lighting, because it’s financial date night.

According to Bankrate, nearly half (45%) of couples in committed relationships admitted to being in the dark about their partner’s finances. Keeping secrets can carry long-term damage, with 43% of respondents believing that keeping money secrets from a partner is as bad (or worse) than physical cheating.

As such, having money conversations early on and regularly will help you stay on top of your finances, set your goals, and avoid misunderstandings later down the line.

Start by defining your core values as a couple. Some questions that can help guide this conversation include:

- What matters to you most in life? Think about the things that are most important to you. Some examples might include your family or friendships, your health, meaningful work, or the ability to make a positive impact.

- How do you want to live your life? Think about how you want to interact with the world and the characteristics you want to embody. Some examples might include curiosity, generosity, integrity, loyalty, or creativity.

By defining your core values, you can then think about the means necessary for the kind of life you want to live. In other words, your core values might influence the financial goals you set.

For example, if one of your core values is a “sense of adventure,” then you and your partner might decide to take a year off from work to travel the world while you’re young, even if it means that your other goals might be put on pause to make it happen. Your core values can help you prioritize the goals that matter to you.

After this, you can move on to more specific questions about your philosophy around financial management, and how to approach it as a couple. These questions can include:

- What is your relationship with money? Is it something that’s meant to be spent, saved, or invested, or a bit of all three? Do you have a positive or negative relationship with it?

- What are some hard limits around spending and money habits? For example, not using Buy Now Pay Later or never gambling.

- How comfortable are you sharing finances and possibly spending each other's money? Do you want to keep finances entirely separate, or combine some or all of them?

- When should your partner run a large purchase by you, and vice-versa? Is there a lower or upper limit?

- How much debt does each partner have, and what is their plan for managing it?

Having these conversations early on and often will work in your favor – and the stats are on your side. According to one survey, 74% of couples felt more comfortable opening up the money conversation before saying “I love you” in a new relationship.

Step 2. Understand Your Current Financial Situation

The next step in creating your financial plan is to sit down with your partner and understand your current situation. By knowing where you’re starting from, you can gain a better sense of what you need to do to reach your goals.

For example, maybe you and your partner have a shared goal of saving up for a down payment on a home, but you’ve had trouble finding room in your budget for savings and you’re not sure why that is.

By taking the time to sit down and go over your accounts, you might realize that the interest rates on your loans are much higher than you had originally thought, and those high rates are making it difficult to get ahead. Instead of using extra money in your budget to save for a down payment, you might decide to prioritize paying off your high-interest loans—saving money in interest payments and ultimately freeing up a lot more money in your budget to be used for building your down payment.

As a rule of thumb, this conversation should include:

- Your income. How much money do each of you bring in every month? Is your income consistent or does it fluctuate? Be sure to consider income from your jobs as well as any additional sources of income, such as investments, rental income, side gigs, and so on.

- Your spending habits. How are you and your partner currently spending money? Which expenses matter most to you? Which expenses are least important to you? Is there any mindless spending that can be cut to free up money for other purposes? How much is available for your goals each month?

- Your debt. How much debt do you and your partner currently carry? This should include all forms of debt including student loans, car loans, personal loans, mortgages, and credit card debt. In addition to knowing how much you owe, it’s also important to know the interest rate charged on each debt, as this will help you get a sense of the real cost of the debt. It will also help you prioritize which debt to pay back first.

- Your current account balances. How much money do you and your partner currently have set aside in various (non-investment) accounts? Be sure to consider your checking and savings accounts, as well as any money you may have set aside in a health savings account (HSA) or flexible spending account (FSA).

- Your investment accounts. If you and your partner currently have investment accounts, note the balances in each of those accounts. Likewise, you should also consider how the balances are allocated to various investments (stocks, bonds, real estate, etc.). This will help you understand how much risk you and your partner are taking cumulatively in your investments. Be sure to consider any retirement accounts such as your 401(k)s, 403(b)s, and IRAsas well as any brokerage, custodial, or other accounts you may own.

- Your insurance policies. If you or your partner currently own any insurance policies, it’s important to understand what type of insurance you have and the benefits and costs of each policy. In cataloging your insurance policies, be sure to consider health insurance, auto insurance, homeowners or renters insurance, life insurance, and disability insurance.

Step 3. Set and Prioritize Your Financial Goals

Now that you have a clear sense of where you are today, you and your partner are ready to discuss your financial goals. While long-term goals such as retirement are important and tend to get a lot of attention, it’s also crucial that you consider your short- and medium-term goals as well.

Some common financial goals for couples to consider discussing together include:

- Building an emergency fund. An emergency fund is meant to be there to cover the unexpected expenses that life occasionally throws at us—and it’s also one of the most effective ways of reducing financial stress so that money is less of an issue between you and your partner. Many consider an emergency fund to be the bedrock of their overall financial plan.

- Paying off debt. If you and your partner currently carry debt, particularly high-interest debt at 7% interest or more - paying it off can cut down on interest costs and free up money for other goals. At Monarch, once you have at least one month of take-home pay in your Emergency Fund, we recommend prioritizing paying off high-interest debt.

- Buying a home. If you’d like to own a home, it’s important to begin planning for the purchase in advance so that you can save for a down payment, closing costs, and moving costs. The same is true if you already own a home but intend to make significant home improvements.

- Growing your family. Do you and your partner hope to start a family one day? If so, what would this look like for you? Will one or both of you be out of the workforce for a time when the baby comes? Might it involve adoption, fostering, fertility treatments, or surrogacy? Would it require moving into a larger home with more space, or relocating from a city to a suburb? All of these are important considerations that may affect your financial plan.

- Potential career changes. If you or your partner are considering a career change in the future, it could have a big impact on your financial plan. This is especially true if making that change would require an up-front investment (in the form of education, for example, or starting a business). Likewise, if such a career change would impact your income significantly (up or down), that should be accounted for as well.

- Hobbies, activities, and passions. Your hobbies and passions are an important part of enjoying life! With this in mind, it’s important to make space for them in your financial plan.

- Retirement. When it comes to saving for retirement, we here at Monarch recommend that you contribute at least enough money to your employer-sponsored retirement savings plan to maximize employer matching contributions. After all, that’s free money and the closest thing you’ll ever get to a guaranteed 100% return on your investments. From there, how much you save will depend on your goals and the unique vision you and your partner have for retirement, but aiming for 15%, including employer matching contributions, is a great rule of thumb.

Prioritizing Your Goals

Armed with your core values and your financial goals, the final step is to prioritize your goals based on what is most important to you as a couple, and based on which goals will help you build a strong financial foundation. We typically recommend picking at least two and no more than four goals to work on at one time, especially as you begin building your financial plan.

Step 4. Choose How to Manage Your Accounts

When it comes to managing finances as a couple, it’s essential to have an idea of how you want to allocate your funds and manage your accounts. How you decide to combine and separate your finances will depend on your own financial philosophy, your level of trust and comfort in your partner, and your long-term picture of your finances with your partner.

There are three primary ways to manage your accounts as a couple: Fully combining your accounts (or the ‘joint’) method, keeping totally separate accounts, or taking a hybrid approach.

Here’s a quick summary of joint vs. separate vs. hybrid accounts in a relationship.

Joint Finances | Separate Accounts | Hybrid Approach | |

What it is | Combining all finances into shared accounts, with shared cards and bank accounts | Keeping accounts separate, with each account in one or the other partner’s name | Keep separate accounts while maintaining one or more shared accounts |

Best for | Couples who want to simplify and merge their finances, and share their income | Couples who want to pay or split bills separately, and who want to keep their finances more private and within their control | Couples who want the unity of a shared account with the security and privacy of separate accounts |

Pros | Simple structure, Encourages financial transparency and teamwork | Less risky, Allows partners more privacy and individual freedom | Allows for shared financial picture while keeping some things separate, Best of of worlds |

Cons | Debts and credit scores are combined, Presents risk if one partner leaves or overspends, Lack of privacy | More complicated, Couples may not be on the same page about finances | Carries some of the risk of joint accounts, Possible chance of couples keeping financial secrets |

Here are the account types in more detail.

Joint Finances

With this method, you merge all of your finances into shared accounts, sharing in both income and expenses and not keeping anything separate. All bills are paid out of one account, and all income (save for separate retirement accounts) is considered shared. According to the Census Bureau, about 40% of all married couples have all of their bank accounts jointly.

This approach is the simplest one, since there’s only one account to keep an eye on, and you don’t have to crunch the numbers on splitting bills. However, it can be risky, as both couples will be taking on each other's liabilities. If one partner goes into debt, or goes bankrupt, your assets could be on the line. If you share a credit card, both your credit scores will be impacted if the utilization ratio gets too high or if you miss any payments.

If you decide to separate, separating out the finances in court can be messy, especially if you don’t have a prenup. You also won’t have any privacy around your transactions, since both partners will be able to see your spending history.

This method requires a high degree of trust and unity in a couple. If you like your privacy, or if you have different habits around saving, spending, and going into debt, you may want to hold back on merging your finances and use a different approach.

Separate Accounts

With the approach, couples keep all bank and expense accounts separate, and pay and save separately by splitting the bills. This way, you limit the risks of merging your finances with your partner, and have a bit more privacy around your savings and spending. According to the Census Bureau, 23% of married couples choose to keep all their accounts separate.

Separate accounts can be a good way to start out as a couple if you’re just beginning to live together, since the risk is mitigated, and if you separate, you won’t have any joint finances to untangle. It can also be helpful if you’re uncomfortable merging incomes due to disparities, or if you and your partner have different spending and saving habits.

This method is somewhat more complicated to maintain than a joint approach, however, since you have to calculate bill splits. You may also feel you have a less unified approach to managing your goals and finances overall.

The Hybrid "Yours, Mine, Ours" Approach

With the hybrid method, couples maintain both separate accounts and have one shared savings account, which they pay expenses out of and contribute to either equally or proportionally. According to the Census Bureau, 17% of couples take a hybrid approach.

Another way to do it is to have separate savings and checking accounts, while sharing credit cards so that expenses are shared and consolidated.

This method offers the best of both worlds, as couples can have a unified vision about their saving and spending benchmarks, while getting the safety and privacy of having separate accounts.

Step 5. Create a Couples Budget

Once you have your prioritized list of goals, you can create a monthly budget that will allow you to work toward these goals.

Start by tallying up your and your partner’s take-home pay. Then, create a list of all of your regular and recurring expenses. Be sure to include expenses that you might not pay on a monthly basis, such as your car insurance premiums, property taxes, etc. that are typically paid every six months. (Just divide the expense by six and add it to your monthly budget to account for it.)

Next, subtract your expenses from your income to determine how much money you have left over to put to work toward your various goals. Use your prioritized list to determine how you want to divide this money across your goals.

Need some help prioritizing? Here are some quick recommendations to get you started:

- Work toward a one-month emergency fund to provide a baseline level of security.

- Purchase adequate health, homeowners (or renters), life, and auto insurance.

- Contribute enough to your employer-sponsored retirement plan to earn your employer match, up to 6% of your income.

- Work toward a full emergency fund while also paying down any high-interest debt. (We recommend a 50/50 split.)

- Once your high-interest debt is paid off, increase your retirement contributions to 10% of your income and continue to increase contributions by at least 1% annually until you get to 15%.

- Start thinking about other goals, like saving for your child’s college expenses or a down payment to purchase a home.

While you’re at it, now is also an excellent time to make a plan for any windfalls you and your partner may receive whether they’re expected or unexpected. This might include work bonuses, tax refunds, vesting RSUs, inheritances, prize winnings, and more.

If you put them to use properly, these windfalls can make a big difference as you work toward your financial goals. But it’s also important that you enjoy them as well. You might, for example, agree that you’ll spend (and enjoy!) 10% of any windfall you and your partner receive while putting the other 90% of the windfall toward whatever goal is your highest priority at the time.

How often should you check in with yourself to gauge your progress and adjust your budget as you accomplish your goals? The sweet spot is usually somewhere between every three and six months.

Now for the last step:

Step 6. Protect Your Finances with Insurance and Estate Planning

Just like you should have a contingency plan for how you'll deal with an unexpected flat tire or serious accident before you embark on a road trip, it's also important to plan for serious issues like a prolonged illness, disability, inability to work, or the death of you or your partner that can derail your financial plan and jeopardize your family's ability to live the life that you want for them.

What does preparing for these possibilities look like? In most cases, it will involve a combination of disability and life insurance - the first, to protect your ability to earn income if you're unable to work; and the second, to provide for your partner and family if you're suddenly no longer around.

According to the Social Security Administration, approximately one in four (24 percent) of today's twenty-year-olds will experience a disability at some point in their lives that will leave them unable to work for at least a year. Yet, according to PolicyGenius, only 31 percent of workers have access to long-term disability insurance through their employers.

With this in mind, if your employer offers long-term disability insurance, we recommend that you take advantage of it and sign up during open enrollment. And if needed, consider purchasing additional coverage that can help you replace a greater percentage of your income if you find yourself unable to work, and which you can take with you if you change employers.

Likewise, you and your partner should consider purchasing private life insurance beyond whatever may be offered by your employers. While many couples will find that they need more, as a starting point we recommend that you purchase at least enough coverage to:

- Allot $10,000 to your final expenses

- Pay off any debt that won't be forgiven upon your death

- Fully stock your emergency fund if you have not finished building one

- Replace at least one full year of your gross income

Finally, it's important to recognize that there are non-monetary steps that you can take to prepare as well. Putting in place a will, power of attorney, and healthcare directive that all work to make your wishes known, can significantly reduce the stress your partner must handle in an already trying time.

Popular Budgeting Methods for Couples

There are a few ways to approach structuring your budget. Here’s a quick overview so you and your partner can choose the one that works best for you, your goals, and your financial lifestyle.

Flex budgeting

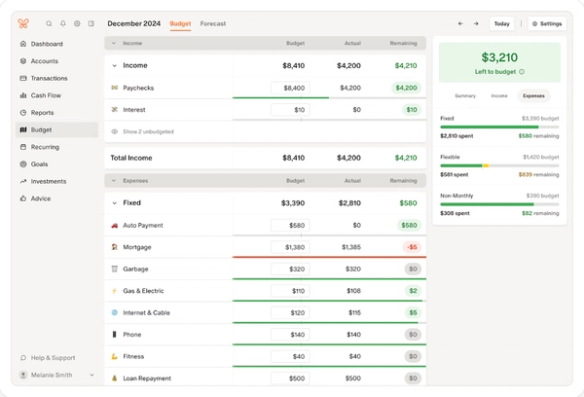

Flex budgeting, also known as number one or bucket budgeting, is when you categorize your spending based on the expense type: fixed, flexible, and non-monthly. Fixed payments are things that stay the same each month, like your rent or mortgage, subscriptions, and debt repayments. Flexible expenses are ones that change each month, like your grocery bill or eating out. Non-monthly expenses include one-time purchases like annual insurance premiums or buying a new dishwasher.

With this method, you can plan out how much you know you’ll spend and put a cap on flexible spending, either by setting a limit on your budget, or only allotting a physical amount of cash or debit transfer each month for your flex allowance.

Category budgeting

Category budgeting is a bit more detail-intensive, where you categorize your spending by where the money goes, like groceries, clothing, gas, utilities, and so on. This method takes a bit more time to plan out, but it can be helpful if you want a more detailed view of where your spending is going, or if you want to limit or track a certain type of expense.

There are a couple of ways to approach category budgeting depending on your financial needs.

- Zero-based budgeting is when you designate every single dollar of your income to a specific purpose, be it for spending, saving, investing, or paying off debt. This means you set strict parameters around how much you spend, and have an extremely clear idea of where your money is going.

- The Envelope Method, where you allocate a certain amount of cash to each “envelope” or category of spending, with the amount you put in the envelope being the limit of what you can spend on it. Any leftover money can be put into savings, or rolled over into the next month’s envelope.

The 50/30/20 Rule

With this rule, you dedicate 50% of your gross income to needs (including tax payments), 30% of it to your wants, and 20% to your savings and investments. Some variations of this rule will dedicate the 20% to debt repayments instead of savings, depending on your financial goals.

This rule is fairly straightforward and provides a flexible, yet structured way of determining what your spending limits are and providing a good pace for building up your savings or paying down debt.

You also don’t have to strictly stick to the categories. For example, if you end up spending less on wants, you can dedicate more money toward your savings.

Which Method is Right for You?

Each budgeting method offers a structure for your spending, and can help you save, invest, manage your finances. Which one will work best for you and your partner, however, will depend on your situation, preferences, and spending habits.

When choosing a method, ask yourself these questions.

- What’s my income like? If you have variable income, or are living paycheck to paycheck, you may want to use a stricter method like zero-based or envelope, or stick to a flex budget to keep a cap on your spending in general.

- What are my financial goals? If you want to aggressively pay down debt and want to maximize your savings, use the flex, zero-based or envelope method, since they focus on limiting spending.

- How much am I tempted to overspend? If you have a tendency to impulse buy, you might want to limit your spending with the envelope method.

- How detailed do I want my budget to be? More detailed methods like the category zero-based can give you more insight to your cash flow, but may require more work to plan out. Flex budgeting, on the other hand, gives you more wiggle room in terms of details.

- How much flexibility do I want? The flex method offers the most flexibility for your spending, with category-based methods like zero-based budgeting offering the least, and the envelope offering somewhere in the middle.

- What works best for my partner? If your partner has a tendency to overspend and wants help managing their purchases, consider either using the flex method with a hard cap on flexible purchases, or a stricter category method like envelope or zero-based.

How to Split Bills Fairly as a Couple

If you want to split expenses instead of combining your income in a general slush fund, figuring out how you want to divide your bills is an important conversation to have early on.

There are a few approaches to splitting bills, each with their own advantages and disadvantages.

- 50/50 split. You split bills payments in half, with each half being paid by one partner. This is the simplest way to split bills, and has the most predictable cost structure. This can be useful for couples with similar incomes.

- Proportional split based on income. Here, you split bills based on how much each partner makes so that the burden of the bills aren’t too much on one partner. For example, if one partner makes $6,000 a month and the other makes $4,000 a month, the first partner would pay 60% of the bill, and the other would pay 40% of the bill. This can be helpful if there’s a large amount of income disparity between a couple.

- One pays bills, one saves. Use one account or income to cover the bills, while the other saves their income. This can be useful if one partner plans to quit working in the future to stay at home, or can provide a good cushion if one partner gets laid off or is unable to work.

Monarch: The Smarter Way for Couples to Manage Money Together

No matter how you decide to split your bills, merge your accounts, or define financial success as a couple, Monarch has your back and the tools to help you succeed.

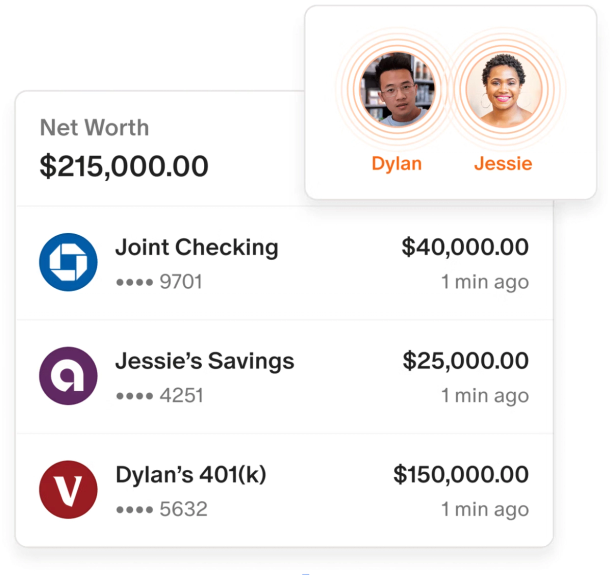

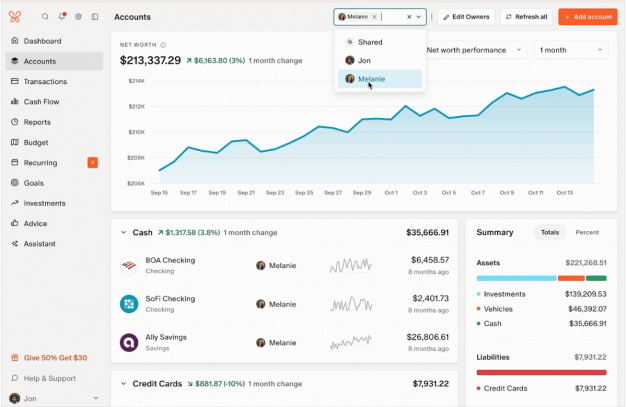

When it comes to managing multiple accounts, Monarch makes it a cinch. You can bring your entire household’s finances all in one place, from joint to merged accounts, by adding partners on Monarch’s account dashboard. This enables you to get an instant snapshot of your net worth, debts, transactions, income, and goal progress without needing to hop through different account logins.

Monarch allows you to create a unified budget for one household, giving you the ability to have a combined budget and shared view.

You can also filter by transaction, so you can track individual spending for separate accounts.

If you have goals you want to fulfil as a couple, you can set either Save Up or Pay Down goals that are shared between you, allowing you to watch your progress and equally contribute.

Best of all: You only need one subscription per couple, helping you save while you manage your finances.

Whether you’re in a long-term relationship, married, or just starting to consider moving in together, Monarch has your back. Give it a try today, and get you and your partner on the same financial page for long-term success.

Start Your Financial Journey Together

Whether you and your partner are engaged, married, or simply in a long-term relationship, taking the time to create a financial plan can help you start working toward the goals that matter to you both.

Looking for a tool to help you identify goals, track your spending, and budget your money? Monarch Money makes it easy to build a budget, track your expenses, and organize all of your accounts in one place—while providing an accurate picture of your financial health as you progress toward your goals.

FAQs

How should couples split bills?

That will depend on your income and how equitable you want your splits to be. Splitting bills 50/50 tends to be the simplest method, while dividing payments based on income can be more manageable for those with larger income disparity. Having one partner pay and the other save can be a quick way to save money quickly, manage expenses, and provide a backup if one partner loses their job.

Should we have joint or separate accounts?

That will depend on your relationship and your level of comfort. Combining finances can make managing money a bit more straightforward, but can put you at a disadvantage if one partner leaves or spends more than you agreed upon. Sit down and discuss it with your partner and, if possible, a financial professional.

What is the 50/30/20 rule for married couples?

The 50/30/20 rule is used to allocate your income, with 50% of your gross income including tax payments going to needs, 30% going to wants, and 20% going to savings, investments, and debt repayments.

How often should couples talk about money?

You should both have regular check-ins on your budget, and address any possible money issues or decisions as they come up. For example, you may want to have a weekly or monthly budgeting check-in where you review your budget, your spending, and your goals, and be able to sit down and discuss a large purchase or financial windfall as it comes up. The key is being open to these conversations as they arise and to have a good pulse on your financial situation.

How much should couples save per month?

It depends on your goals. With the 50/30/20 rule, you aim to save about 20% of your income a month. If you have a particular goal in mind, like saving up for a house, you may want to save more. If you’re paying down debt, then you’ll want to save less and focus on paying down your loans.

How do you budget when partners have different incomes?

There are a couple of different approaches. If you merge your finances fully, you can treat your combined incomes as one household income and base your budgeting on that, with expenses and savings also being shared. If you decide to keep your finances more separate, you can choose to split bills and savings proportionally to keep things fair.