Debt is a part of life, and it’s not uncommon to have multiple different kinds of debt. The average American owes $105,580 in debt across their mortgage, student loans, auto loans, retail and consumer cards, and personal loans, according to Experian.

Tackling your debt head-on, even with multiple balances, doesn’t have to be confusing. Using repayment strategies like the debt snowball and the debt avalanche method can help you pay off your debt faster, help you save on interest, and help you build confidence and ownership over your financial well-being.

Key Takeaways

- The debt snowball and the debt avalanche are two debt repayment strategies that help you pay off multiple debts more quickly by focus-firing your extra payments and rolling them into subsequent payments as you pay off each balance.

- The debt snowball focuses on paying off lower balances first, while the debt avalanche focuses on debts with the highest interest rates.

- Using Monarch for either debt repayment strategy can help you keep tabs on your progress and integrate your methods into your overall financial picture.

What is the Debt Snowball Method?

The debt snowball method is a repayment strategy where you pay as much as possible on your lowest-balance debt while making the minimum payments on all your other debts.

As you pay off each debt, you roll each of your former payments into your new payment, keeping your total monthly debt payment consistent while focusing one at a time on each debt balance until it’s paid off.

By doing this, you can knock out balances quickly while hopefully getting some quick wins (and positive reinforcement!) under your belt.

Example Scenario

Let’s say you have five loans you want to tackle. For now we’ll ignore the interest for the sake of an example, though keep in mind that it will be a factor when you’re paying off debt in real life.

- A $25,000 student loan with a $500 monthly payment

- A $10,000 auto loan with a $150 monthly payment

- A $5,000 credit card balance with a $130 monthly payment

- A $2,500 personal loan with a $50 monthly payment

- A $3,000 medical bill with $70 monthly payment

Let’s say you have an extra $200 to add to your monthly payments. In total, you can expect to pay $1100 each month with your minimum monthly payments and your extra payment.

With the debt snowball, you would pay off the $2,500 personal loan first, with monthly payments of your minimum monthly payment plus your extra payment, bringing the total to $250 a month towards that debt. This will take you 10 months to pay off.

Next, you’ll tackle your $3,000 medical bill. After 10 months of minimum payments, the balance will be $2,300. Now you can roll your previous payment of $250 into your minimum payment, bringing the payment total on this debt to $320 per month. It only will take you another eight months to fully pay off this loan.

Next up is the $5,000 credit card balance, which, when you’re ready to focus on it, should be at $2,660. With a new monthly payment of $450 towards this debt, it will only take another six months to pay it off.

Next is the $10,000 auto loan, of which $6,400 should be left. Your monthly payment of $600 will take care of this loan in less than a year (11 months).

Finally, your student loan of $25,000 should be ready to be paid off. With only $7,500 to pay down, and a monthly payment of $1,100 it should take you about seven months to pay off this loan.

In about three and a half years (42 months), using the snowball method and ignoring any interest payments, you’ll have paid off $45,500 of debt.

What is the Debt Avalanche Method?

The debt avalanche method has you focus on debt with the highest interest rates. Like the snowball method, you’ll direct your extra payments towards one debt balance at a time while paying the minimum on your other debts.

In this case, the debt you prioritize is the one with the highest interest rate. (If multiple debts have the same interest rate, you’ll start with the one with the smallest balance first.) As you pay off balances in order of interest rate, you roll your previous payment into the new payment, “avalanching” the payment into the next debt.

While the debt avalanche is slightly more complicated than the snowball method, and doesn’t pay off individual balances as quickly as the debt snowball, which may not be as motivating, it can save you significantly more on overall interest paid over time, which is the reason why Monarch recommends starting with this method if you don’t know where to begin.

Example Scenario

Let’s say you have multiple debts to pay, with different interest rates and balances.

- A $25,000 in student debt with a 6% interest rate and a $500 monthly payment

- A $10,000 auto loan with a 7% interest rate and a $150 monthly payment

- A $5,000 in credit card balance with a 20% interest rate and a $140 monthly payment

- A $2,500 personal loan with a 10% interest rate and a $50 monthly payment

- A $3,000 medical bill with a 15% interest rate and a $70 monthly payment

Let’s say you have an extra $200 to devote each month to extra debt payments.

To start, you would focus on the debt with the highest interest rate: the $5,000 credit card balance with a 20% rate. With your minimum payment plus your extra payment, you would have $340 per month to put toward this debt, paying it off in 19 months.

Next up would be the medical bill, with a 15% interest rate. With your $400 monthly payment, you can knock it out in another six months, paying it off after a total of 25 months.

Next is the personal loan with an interest rate of 10%. With a $450 monthly payment, the remaining balance is gone after four months of focusing on it, paying it off in a total of 29 months.

Your auto loan is next in line at 7% interest. With your focused payment of $600 per month, it will take 13 more months to pay it off, or 42 months in total.

Finally, you’ll pay off the student loan with a 6% interest rate. Bundled together, your total payment will be $1100 per month, knocking the loan out only seven months after the avalanche hits, paying it off and getting you debt-free in about four years (49 months).

Snowball vs. Avalanche: A Side-by-Side Comparison

While the debt snowball and the debt avalanche are similar in terms of how they operate, how they impact your debt repayment journey will differ a bit. Here’s a side-by-side comparison of the two methods.

Debt Snowball | Debt Avalanche | |

Repayment Method | Focus on paying off the smallest balances first, then roll payments into next-smallest debt as you pay down | Focus on paying off debt with the highest interest, then roll payments into next-highest interest as you pay down |

Total Monthly Payment Amount | Stays the same throughout the repayment process | Stays the same throughout the repayment process |

Number of Payments | Generally lower | Generally higher |

Time to Repayment | Generally similar | Generally similar |

Financial Outcome | More interest paid | Less interest paid |

Key Advantages | Financial motivation as you pay off smaller balances quickly | More overall money saved as less interest is charged on balances |

Debt Snowball vs Debt Avalanche in Practice

To put the snowball and avalanche strategies in action, let’s compare how they work out when implemented in a real debt scenario.

Let’s say you have multiple debts you want to tackle.

- Debt 1 has a balance of $3,000 with a 13% interest rate and $75 monthly minimum payment

- Debt 2 has a balance of $7,500 with a 22% interest rate and a $150 minimum monthly payment

- Debt 3 has a balance of $7,000 with an 8% interest rate and a $50 minimum monthly payment

- Debt 4 has a balance of $20,000 with a 14% interest rate and a $415 minimum monthly payment

- Debt 5 has a balance of $1,500 with a 15% interest rate and a $40 monthly minimum payment

Like before, let’s say you have $250 extra each month to devote to extra payments, totaling your monthly payment to $980.

You have a few options. You can keep making the minimum monthly payments. You can distribute your $250 evenly over the five debts and put $50 toward each monthly payment, or you can use the snowball or avalanche strategies.

Here’s how each methodology would work out.

Minimum Payments Only | Even Spread | Snowball Method | Avalanche Method | |

Total Amount Paid | $73,415 | $52,383 | $51,233 | $48,349 |

Total Interest Paid | $37,415 | $16,383 | $15,233 | $12,349 |

Time to Pay Off | 392 months | 95 months | 54 months | 51 months |

As you can see, both the debt snowball and the debt avalanche will save you more on interest than just making the minimum payments, or by spreading your extra payments evenly over all five balances.

With the snowball method you’ll make fewer overall payments, since you’re closing accounts more quickly. However, the avalanche method will be your best bet for saving on interest. In this case, it will save you:

- $25,066 over only making minimum payments

- $4,034 over making evenly spaced payments

- $2,884 over using the snowball method

Moreover, it’s the fastest method, allowing you to pay off your debt in less than four and a half years (51 months). The snowball method takes four and a half years (54 months), while the even distribution method takes nearly 8 years (95 months). Making just the minimum payments will take you about 32 years (392 months).

Which Debt Payoff Strategy is Best for You?

Ultimately which strategy you choose to go with will come down to not just the math, but which one works best for your overall situation and attitude toward the debt repayment process.

Since the debt snowball gives you easy “wins” as you pay off your balances and can cross off loans as you go, it can help motivate you as you go.

On the other hand, the debt avalanche nearly always saves you on interest in the long run. It can tackle high-interest balances before they get out of hand.

It’s a good idea to use a calculator to see how much you’ll save with each strategy, get an idea of your payoff timeline, and to map out your plan so you can pick the best method for you.

Pros and Cons of the Debt Snowball

Here are some pros and cons of the debt snowball to consider.

Debt Snowball Pros | Debt Snowball Cons |

Pay off balances quickly for motivation | More overall interest paid |

Fewer overall payments | Generally slightly longer timeline |

Simpler to implement | Less money saved |

You might want to choose the debt snowball if:

- You want the quicker motivation knocking out debt balances early on

- You prefer to keep the plan simple

- You want to make fewer overall monthly payments

- Your debts have flexible interest rates that you don’t want to keep track of

- You’re struggling with the debt repayment process and you want an easy starting point

Pros and Cons of the Debt Avalanche

Here are some of the pros and cons of the debt avalanche to consider.

Debt Avalanche Pros | Debt Avalanche Cons |

Less overall interest paid | More overall payments made |

Generally slightly quicker | Can be less motivational than the snowball method |

Less money paid in total | Requires keeping track of interest rates |

You might want to choose the debt avalanche if:

- You want to save on the amount of interest paid

- You have debts with high rates that are racking up interest quickly

- You want to pay off your total debt more quickly

- You’re okay with making more payments and keeping more balances open

- You don’t mind keeping track of interest rates as you pay

Tips to Succeed (No Matter Which Method You Choose)

While both the snowball and avalanche methods will speed up the process, paying off debt is a marathon, not a sprint. Keeping yourself disciplined and motivated is key, as well as staying focused on completing your goal of paying off your debt.

Here are some tips to help you stay on course.

- Map out your plan. Giving yourself a solid start and end date, and seeing when each debt will be paid off, which help you stay on track and know what’s ahead of you.

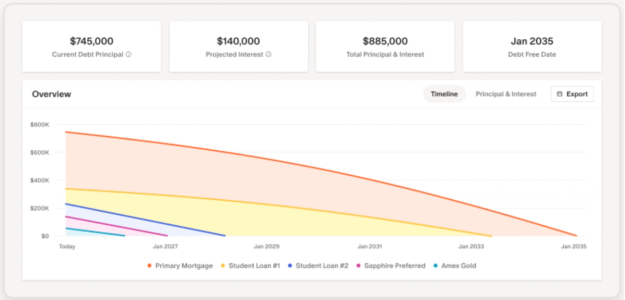

- Track your progress. Watching your debt shrink as you pay it down can give you a huge psychological boost, especially if you use a visual tracker like a thermometer or Monarch’s debt paydown tool.

- Set up automatic payments. Having your balance paid off in the background will help make the process smoother. Just make sure you stay on top of rolling over your payments as you pay off each balance.

- Put as much extra money toward your payments. Extra payments, even on an irregular basis, can go a long way to help pay down your balance. Side hustle money, windfalls, and work bonuses all work well to this end.

- Celebrate your wins. With every balance you pay off, take a moment to acknowledge your hard work. Don’t go on a shopping spree, of course, but do something for yourself to celebrate your hard work and dedication.

- Stay on top of your budget. Keeping an eye on your monthly spending will help you make sure you have enough for your monthly payments, and see if there’s any wiggle room to make extra payments.

How to Use Monarch to Power Your Debt Payoff Plan

No matter which repayment plan you use, Monarch can help you set and stick to your goals throughout your debt repayment journey, seamlessly integrating your entire financial picture with your debt repayment plan.

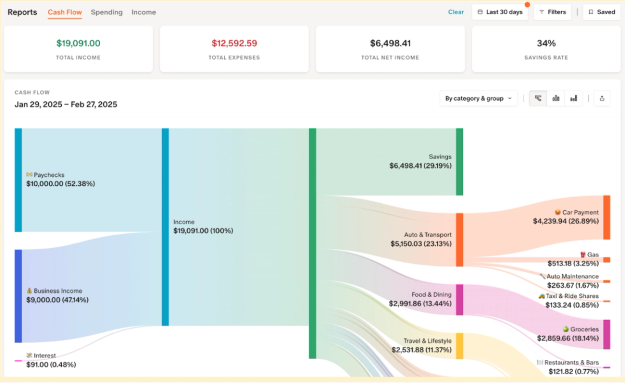

First, you can use Monarch’s budgeting system to get a financial snapshot and figure out how much you have to devote to your debt repayment plan.

Next up is setting goals. Monarch allows you to set up Pay Down goals that track your payment progress over time. You can set up multiple goals for paying off different debts, and set your monthly payments for each one.

Monarch helps you track your progress with the Debt Dashboard, which gives you a quick overview of your repayment trajectory and when your expected payoff date is based on your monthly payments, remaining balance, and interest.

If you want a holistic way to manage your finances, integrate your debt repayments into your budget, and know your debt repayment journey at a glance, give Monarch a try today.

Conclusion

Using your payments strategically will help you pay off your debt faster, save you on interest, and give you a psychological boost that can help you stay motivated for the repayment journey. Both the debt snowball and the debt avalanche can help you strategize, with the debt snowball helping you pay down balances and close accounts quickly, and the debt avalanche helping you save on interest by tackling debt with high rates. While both have their advantages and disadvantages, you can choose and implement the strategy that works best for you with the power of Monarch.

FAQs

Can I switch from debt snowball to debt avalanche?

You can, or vice-versa. You may end up paying a bit more interest if you switch from the avalanche to the snowball method. You can plug your remaining balances into a snowball/avalanche calculator for your new timeline if you’re unsure.

Should I use the debt snowball or the avalanche if I’m still using my credit card?

It’s not a good idea to add more to your balance as you’re trying to pay it off, or else your timeline and strategy will be thrown off. Freeze your cards (literally if needed!) and keep your spending down so you’re not growing your debt as you’re trying to repay it.

Should I save for retirement when I’m paying off debt?

Monarch doesn’t recommend saving for retirement beyond any employer match when you have debt with interest rates above 7%, Saving for retirement is important in the long-run, but paying off your debt quickly can often save you significantly more than you might earn on investments. See how quickly you can pay off your debt if you dedicate your retirement payments toward it, and how much interest you would save. Once you only have debts remaining with rates at or below 7%, you can switch your focus back to saving for retirement. If you’re unsure what’s best for your specific circumstances, contact a financial professional.

What should I do if I can’t make payments?

You have a few options. First, see if you can bring in extra income to cover your payments. If you’re facing temporary hardship, reach out to your lender and see if they’ll allow you to defer payments while you get back on your feet. Refinancing may also help you get a lower interest rate and monthly payments, although most lenders won’t refinance your debt if you don’t have high enough income. You can work with a nonprofit credit counseling agency if those are not options, such as https://www.nfcc.org/

Should I save for my emergency fund or focus on paying off debt?

Start with a mini emergency fund. Instead of building a full three to nine month emergency fund, we recommend starting with either $1,000 or one month of take-home pay. Once you have that in place, then you can focus on paying off debt with interest rates above 7%. After those debts are paid off, you can get back to building a more robust emergency fund.

Should I consolidate my debt or use the snowball method?

It depends. Sometimes consolidation can get you a better overall interest rate and help simplify your payments. However, consolidation can come with closing costs and other fees, and may have you racking up more interest in the end, especially if you continue to use revolving debt like credit cards. Use a consolidation calculator and see how much you’ll end up paying overall.