What are Budget Categories?

Budget categories are groupings of expenses and income that organize your money into manageable segments. Instead of tracking every transaction individually, you sort spending into buckets like housing, transportation, food, and savings, making it easier to see where your money goes and identify areas to adjust.

Choosing the right budgeting categories can help you control your spending. There may be times when surprise expenses arise, but leaving room for each category provides you with more flexibility to weather the changes.

Thinking through your personal budget categories will help you customize a spending and saving plan that makes sense for you and aligns with your values. It will also give you a more granular understanding of where your money goes. You might choose to track what you spend on dining out, takeout, and coffee runs, but that level of detail also takes more work.

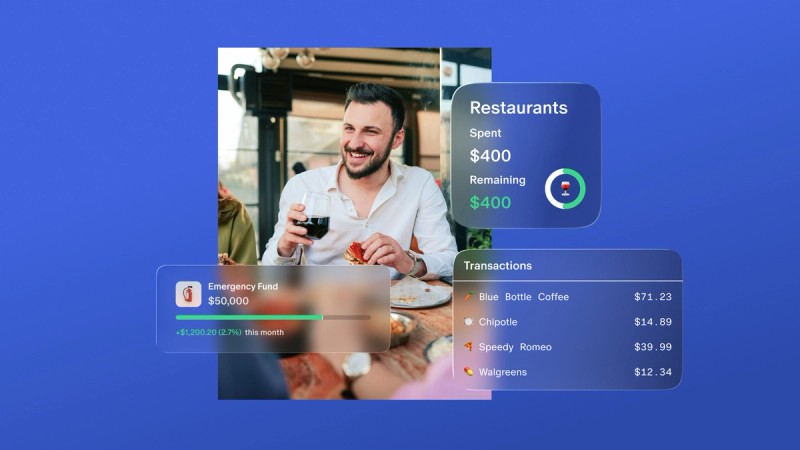

The key is to find a balance you’re comfortable with, so you’ll get the right amount of info for the right amount of effort. Using budgeting tools like Monarch Money can make it easier to experiment and find that perfect balance!

(Be sure to see how Flex budgeting works in Monarch.)

Below is a budget categories list with built-in flexibility for managing money that can grow and change with your lifestyle.

Key Takeaways

- Budget categories are organizational groupings that sort your income and expenses into manageable segments like housing, food, transportation, and savings

- The sweet spot is 15-25 budget categories, enough detail for clarity without becoming overwhelming

- Organize categories into three types: fixed expenses (needs), flexible expenses (wants), and non-monthly/irregular expenses

- Always include savings, investing, and debt repayment as budget categories , not afterthoughts

- The 50/30/20 rule suggests allocating 50% to needs, 30% to wants, and 20% to savings and debt repayment

The Case for Budgeting Categories

Keeping track of different expense categories for your budget has two big advantages.

- Discover opportunities to spend less (and save more).

- Make informed decisions to make faster progress toward your goals.

The best way to build out your budget is to sort all your costs into three main categories: Fixed expenses, flex expenses, and non-monthly expenses.

From there, it’s up to you how detailed you’d like to get with your smaller subcategories. Essentially, you can either have your three big categories — or 30, 50, or 100 categories. It really depends on how much granularity you’d like.

Pro tip: The Monarch Money app can help you set up and adjust your budget items while making it easy to track fixed expenses separately from daily spending.

Budget Category Percentage Guidelines

While every budget is personal, these percentage benchmarks provide helpful starting points based on your take-home pay:

Category | Recommended % | Example ($5,000/month) |

Housing | 25-30% | $1,250-$1,500 |

Transportation | 10-15% | $500-$750 |

Food (Groceries + Dining) | 10-15% | $500-$750 |

Utilities | 5-10% | $250-$500 |

Insurance | 10-15% | $500-$750 |

Healthcare | 5-10% | $250-$500 |

Savings & Debt Repayment | 10-20% | $500-$1,000 |

Personal & Entertainment | 5-10% | $250-$500 |

Miscellaneous | 1-5% | $50-$250 |

These percentages are guidelines, not rules. Your circumstances whether you live in a high cost-of-living city, have children, or carry significant debt - will influence your actual allocations. The goal is awareness, not perfection.

How Budget Categories Fit the 50/30/20 Rule

The 50/30/20 budgeting method is one of the most popular frameworks for organizing money. Here's how it works and how these 23 categories map to each bucket:

- 50% — Needs (Fixed Expenses) Half of your take-home pay goes toward essential expenses you can't avoid: housing, utilities, groceries, insurance premiums, healthcare costs, minimum debt payments, transportation, and childcare.

- 30% — Wants (Flexible Expenses) Nearly a third of your income funds lifestyle choices that improve quality of life but aren't strictly necessary: dining out, entertainment, hobbies, shopping, personal care, gym memberships, streaming subscriptions, and vacations.

- 20% — Savings and Debt Repayment The final portion builds wealth and eliminates debt: emergency fund contributions, retirement savings, other savings goals, extra debt payments above minimums, and investments.

This framework provides guardrails while allowing flexibility within each bucket. If you're carrying high-interest debt, you might temporarily shift some "wants" money toward debt repayment until you're debt-free.

To help get you started, here are 23 common categories to consider.

Main Budgeting Category 1: Fixed Expenses

Fixed expenses are monthly bills that stay the same on a month-to-month basis. These recurring charges are the easiest to plan for because there are no surprises. Even better, you can “set and forget” your fixed expenses by automating your payments.

For example, a monthly Netflix subscription that only increases every few years is a fixed expense. A water bill that changes every month is not.

Here are nine fixed expenses budget categories:

- House expenses: Whether you rent or own a home, you know your main monthly mortgage payment or rent payment is the same each month.

- Pro Tip: If you have a mortgage, additional house expenses like your property taxes and insurance or HOA fees may be rolled into your mortgage payment, so you won’t have to account for them separately. If they’re not escrowed, you can check with your bank or your latest mortgage statement to see what is and isn’t included in your monthly mortgage payment.

- Childcare or pet care: For the fixed expenses budget category, you’ll only track fixed recurring bills that you pay monthly. So if you pay monthly tuition, day care, or a monthly fee for a dog walking service, it will go into your fixed expenses bucket.

- Regular self care: If you regularly see a therapist, acupuncturist, or other wellness service for a fixed monthly cost, add it to your budget app or budget spreadsheet.

- Utilities: If you’re on a plan to pay the same amount for your gas, electric, and water service each month, then it belongs under the fixed expenses heading.

- Phone, internet, cable: Typically, these are fixed expenses unless you occasionally have extra charges for using features like phone calls made abroad or pay-per-view movies. But your base bill amount would go into your fixed expenses as a budget item.

- Cars: If you’re paying off an auto loan or lease in fixed monthly installments, or you make monthly insurance payments, you’ll include those car expenses in this budget category.

- Memberships and subscriptions: Remember, the key word is fixed expenses, so anything recurring like gym membership fees, club dues, or streaming services should go here.

- Fixed debt: This includes any type of loan with a fixed payment, like student loans, or minimum debt payment amounts on credit card balances you’re paying off.

- Monthly donations: If you give a consistent amount to a charity or your house of worship each month, account for it here.

- Pro Tip: When you’re looking to trim your budget, identifying a fixed monthly expense you can reduce or eliminate can save you money every month, and create a bigger impact over time. That’s why financial experts recommend cutting out things like a streaming subscription you rarely use, being more energy efficient to lower your gas and electric bills, or switching insurance carriers.

Main Budgeting Category 2: Flexible Expenses

Beyond fixed expenses, many of your expenses are ongoing but less predictable, as their amounts fluctuate regularly. Think of flexible expenses as your everyday spending. In most cases, you have more control over how much you spend in these monthly budget categories.

A good strategy is to keep a separate account for your flexible expenses. In that account, maintain a balance that’s a bit more than you think you’ll spend. That way you’ll always have a little buffer in case you go over.

Reevaluate your flex expenses every month when you sit down with your budget. Make adjustments as needed. For example, you might add more money to your flex expense account if gas prices go up and it costs you more to fill your tank, or if you take up something new that costs money, like pickleball.

Here are six flex expenses budget categories:

- Groceries: If you’re a regular grocery shopper, you probably have an approximate idea of what you spend each week at the supermarket. But with prices up and changing family dynamics, groceries definitely aren’t a fixed number. If you’re not sure how much to budget, add up what you spent on groceries over the last couple of months and take an average.

- Pro Tip: Boost your grocery budget in summer months or around holidays when you’ll entertain more.

- Out-of-pocket healthcare: Make sure your personal budgeting categories include co-payments for doctors visits, medications, medical supplies, vaccinations, dental work, and other anticipated costs for preventative care. This doesn’t include unexpected medical costs. You can pay for those from your emergency fund.

- Transportation: If you’re a subway commuter, or you pay for parking, take rideshares regularly, put gas in your car, or pay tolls for bridges and tunnels, be prepared for these budget category costs by allocating an estimated amount for them.

- Dining out, entertainment, hobbies: Many people don’t realize how much they spend in this category until they start tracking their spending. But if you plan ahead for the things that bring you joy by budgeting for them, you can enjoy them without hurting your finances.

- Grooming: Everyone in the family needs an occasional haircut (maybe even your pets!), or perhaps you take an occasional trip to the nail salon or for a waxing service. As long as you account for it in your budget, you’ll have the cash on hand to cover it.

- Miscellaneous: This umbrella category exists because real life doesn't fit neatly into categories. Everyone has random expenses: birthday cards, parking meters, or unexpected household items.

- Sizing your miscellaneous category: Aim for 1-5% of your income. If you're consistently spending more than 5% on miscellaneous, it's a sign you need additional categories to capture recurring expenses you haven't accounted for.

- Miscellaneous vs. emergency fund: Your miscellaneous category covers small, unpredictable expenses (a last-minute gift, unexpected parking fees). Your emergency fund covers larger financial shocks (job loss, major car repair, medical emergency). Don't confuse the two.

Pro Tip: To simplify how you track the items in your flex spending budget categories, try breaking up your monthly flex expenses into a weekly allowance. So for example, if the total of your flexible expenses is $2,000, then you know you should try to limit your total flex spending to around $500 each week. If you go a little over in one category (maybe you went to a baseball game this week), then you can cut back in other categories to compensate. Or maybe you spent extra on groceries to stock up on specific sales, but now you can do some meal prep and save money by not ordering breakfast and lunch out at work.

Main Budget Category 3: Non-Monthly Expenses

The last big umbrella budget category is non-monthly expenses. There are items that could easily become budget-busters if you don’t plan for them. If you’ve ever been blindsided by having to pay for a string of expenses that pop up all at once (like getting invited to three weddings in April, the same month your quarterly property taxes are due), then you know it can cause financial stress that isn’t fun to deal with.

How can you be sure you don’t forget anything? Browse your past purchase history (credit card statements and bank statements) to help jog your memory so you don’t leave any critical non-monthly expenses out.

Pro Tip: To come up with a set amount to allocate to your non-monthly expense subcategories, try using an “escrow approach” where you estimate how much you spend on these items each year and then divide by 12. So if you spend $3,000 on your annual family vacation, you could put aside $250 every month to cover it.

Here are eight non-monthly expenses budget categories:

- Gifts and entertaining: Birthdays, anniversaries, holidays and other events and milestones come up throughout the year. Often, people end up relying on plastic to buy gifts or pay for parties. Budgeting for these occasions can help you avoid interest on credit purchases.

- Travel and vacations: This is another area where people tend to rack up credit card debt, but planning ahead can help you avoid surprises. If you take an annual camping trip with the family, figure out what it will cost, break that amount up into 12 payments, and add it to your budget.

- Home and car maintenance: Staying on top of regular maintenance can save you money in the long run by extending the life of your vehicle and home systems. Whether it’s your seasonal HVAC servicing, oil changes for your car, or quarterly gutter cleaning, put a little aside for the items in this budget category every month.

- Property taxes: If this cost isn’t escrowed with your mortgage, you may pay it quarterly or annually. Either way, be ready for it. You should also be aware of when your local assessor reassesses values, so you can take any increases into account.

- Tuition if paid semiannually or annually: If you’re responsible to make a large payment all at once, setting it aside a little at a time can prevent you from ending up cash-strapped.

- Summer camp: Keeping the kiddos occupied and enriched in the summer months can get expensive. It’s definitely easier to deal with camp costs if you can save for them a little each month — in your non-monthly expense account — until your bill is due.

- Clothing or home accessories: Whether it’s back-to-school shopping or decorative items for your home, being able to draw from saved non-monthly funds can help you feel less stressed than if you faced that big cost all at once..

- Insurance premiums or taxes that are due quarterly or annually: Your budget can take a hard hit when lump sum insurance payments come due — unless you’ve already saved the money for the items in this budget category in your non-monthly account.

- Pro Tip: If you have the means, try to seed an account with three to six months’ of non-monthly expenses up front so you can get ahead of costs as they arise, and have a buffer if you spend a bit more.

Financial Goals Categories

You may be wondering how savings goals fit into your budget. Rather than treating them as an afterthought with "leftover" money, modern budgeting treats savings, investing, and debt repayment as non-negotiable categories that come first—a "pay yourself first" approach.

- Emergency Fund: The foundation for financial stability. Contributions should be consistent monthly until you reach 3-6 months of expenses. Without one, a single unexpected expense can derail your entire financial plan.

- Retirement Savings: A top priority. If your employer offers matching contributions, contribute enough to receive the full match—that's free money. Even small contributions now compound significantly over time.

- Other Savings: A catch-all for short and medium-term goals: home down payment, renovations, vacations, or starting a business. Consider creating separate sinking funds for major goals.

- Investments: Separate from retirement, this covers taxable investment accounts for wealth building and longer-term goals.

- Debt Repayment - Credit Cards: Focus on high-interest debt aggressively. Credit card rates often exceed 20%, making this debt incredibly expensive to carry.

- Debt Repayment - Student Loans: Always account for student loan payments. These are obligations requiring consistent tracking.

- Debt Repayment - Other Loans: Covers auto loans, personal loans, and medical debt. Tracking individual debts helps you stay motivated to pay them off.

If you want more disposable income to fast-track any of these goals, your budget categories help identify savings opportunities. For instance, reducing one or more flexible expenses—like cutting entertainment in half—can accelerate debt payoff significantly.

How Budgeting Can Fast-Track Your Goals

If you want more disposable income to fast-track any of your goals, budget categories can help you easily identify possible savings opportunities. For instance, if you have lingering high-interest debt, take a look at your budget categories and reduce spending in one or more of your flexible expenses (such as cutting your entertainment allowance in half). You could also pause a recurring membership or subscription from your fixed expenses for a few months.

High-interest debt can cause you a lot more financial trouble than a Hulu Live subscription or a night out every week is worth. If you pay down $7,000 of debt at 22% interest in one year instead of five, you’ll save yourself almost $6,000 in interest payments.

General Budget Category Tips

So now that you have a sense of how to break up your budget into categories, you’ll want a way to track the money going in and out. Here’s how it can work in practice:

- Split your income between two checking accounts. In one account, leave enough (plus a slight cushion) to cover all your fixed payments, which you can automate. Then, have a second account to use for all of your daily spending. You’ll know your fixed expenses are taken care of, and you can more easily keep tabs on the spending portion of your budget.

For non-monthly expenses, since they come up less often, open a savings account. Keep this separate from your emergency fund, which is money you won’t touch unless it’s absolutely necessary.

How Couples Can Manage Budget Categories Together

Money is one of the leading causes of marriage strife. Use Monarch's shared household view so both partners have full visibility into finances. Clear categories and shared access guide discussions and reduce conflict.

How to approach shared expenses:

- Equal split (50/50): Each partner contributes equally to shared expenses regardless of income

- Proportional split: Each partner contributes based on their percentage of household income. For example, if one partner earns $100,000 and the other earns $50,000, the higher earner might cover 67% of shared expenses while the other covers 33%

- Hybrid approach: Combine finances for shared expenses (housing, utilities, groceries) while maintaining separate "personal spending" categories for individual discretionary purchases

There's no right answer - couples must find what works for their relationship. This requires honest communication, transparency, and clarity about each person's financial situation.

Make Your Budget Categories List Work for You

The best thing about budgeting categories is that you can easily customize and tweak them as your spending habits change. If you use intuitive software to track your spending and monitor your budget in real time, you can make updates in just a few clicks. Give Monarch a try and customize the perfect budget for you.

FAQs

How many budget categories should I have?

The sweet spot is 15-25 categories. This provides enough detail to understand spending without becoming overwhelming. Start with essentials (housing, food, transportation, utilities, savings) and add more as you identify recurring expenses needing separate tracking.

How many budget categories is too many?

More than 30 categories likely over-complicates your budget. Warning signs: spending more time categorizing than analyzing, multiple categories with minimal activity, or forgetting what belongs where. Consolidate where it makes sense.

What is the 50/30/20 budget rule?

The 50/30/20 rule divides after-tax income into three buckets: 50% for needs (housing, utilities, groceries, insurance), 30% for wants (dining out, entertainment, hobbies), and 20% for savings and debt repayment. It's a simple framework providing structure without detailed category tracking.

Should I include savings as a budget category?

Yes, definitely. Treating savings as a budget category rather than an afterthought, ensures you prioritize it. The "pay yourself first" approach means allocating money to savings and investments before spending on discretionary categories.

What are the essential budget categories everyone needs?

At minimum: housing, utilities, food/groceries, transportation, insurance, healthcare, and savings. Add categories based on your situation—childcare for parents, student loans for borrowers, pet care for animal owners.