Monarch Blog

We're on a mission to make better financial outcomes available to everyone. Read our latest thoughts and insights.

Featured

How to Discuss Money Values With Your Partner

Money talks are easier when you start with what matters most. Your values are a low-stakes way to get aligned with your partner—without diving straight into dollars.

Categories

February 7, 2026

How to Make a Budget From Scratch and Keep It on Track

Stop wondering where your money went. Follow this 9 step plan to build a budget that fits your life, set spending limits, and stay on track, then use Monarch to automate tracking, categories, alerts, and progress toward your goals.

February 6, 2026

Financial Planning for Couples: Build Wealth Together in 6 Steps

Money doesn’t have to be a source of stress - it can be a tool you and your partner use to build the life you want. This guide walks you through a simple 6-step plan to get aligned on goals, create a budget that works for both of you, and make steady progress as a team

January 31, 2026

Debt Snowball vs. Avalanche: Choose Your Best Payoff Strategy

Ready to crush your debt faster? The snowball method delivers quick wins to keep you motivated, while the avalanche method saves you thousands in interest. Discover which strategy matches your goals and start your journey to debt-free living today.

January 18, 2026

401(k) Withdrawals: How to Avoid Penalties and Save More

Withdrawing from your 401(k) comes with rules that could cost you thousands if you get them wrong. This guide covers everything from early withdrawal penalties and tax implications to RMD requirements and smart strategies that keep more money in your pocket during withdrawal.

January 17, 2026

Student Loans Guide: How to Choose, Apply, and Repay Wisely

Student loans don't have to be overwhelming. This guide breaks down federal vs. private options, walks you through the application process, and shares smart strategies to pay off your debt faster, so you can invest in your future with confidence.

January 13, 2026

IRA vs 401(k): Key Differences and How to Use Both

Unsure whether to prioritize a 401(k) or IRA? The good news: you don't have to choose. Learn how to use both strategically to supercharge your retirement savings.

December 31, 2025

23 Budget Categories You Need in Your Budget

Creating a budget starts with three main budget categories: fixed, flexible, and non-monthly. Grouping expenses in those three buckets makes budgeting easier.

December 30, 2025

How to Improve Your Credit Score in 30-90 Days

A better credit score is closer than you think. Follow this step-by-step 30-90 day plan to raise your score using proven, data-backed strategies.

December 30, 2025

Saving vs Investing: When to Save, When to Invest

Saving protects your money for emergencies and short-term goals, while investing grows your wealth over the long term. Learn how to balance both and avoid the costly mistakes most people make.

Subscribe to our personal finance newsletter

Sign up with your email to receive all our latest blog posts directly in your inbox.

December 26, 2025

Types of Loans: What to Know Before You Borrow

Loans can be confusing, but choosing the right one doesn’t have to be. This guide explains the most common loan types and shows you how to compare rates, payments, and risks so you can borrow with confidence.

December 26, 2025

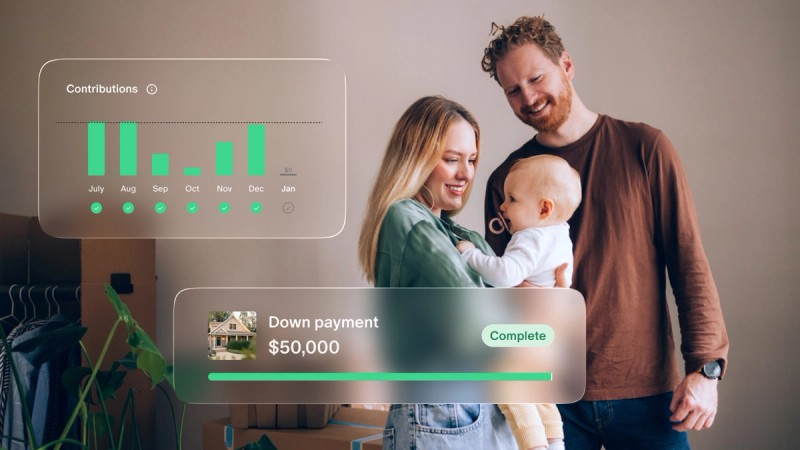

How to Save for a House in 5 Practical Steps

Saving for a house can feel overwhelming, but with the right plan, it’s absolutely achievable. This step-by-step guide shows you how to calculate your savings goal, budget effectively, reduce debt, grow your income, and track your progress along the way. With smart strategies and the right tools, you can turn homeownership from a distant goal into a real plan.

December 26, 2025

What Is an Emergency Fund and How Much Do You Need?

Life is unpredictable, but your finances don’t have to be. This guide explains what an emergency fund is, how much you should save, where to keep it, and how to build one step by step without overwhelming your budget. Start creating a financial safety net that protects you from debt, stress, and unexpected expenses.